With Zcash crumbling because major developers left after the pump and dump and project oversight, are people looking for a privacy cryptocurrency and moving to Monero? Or is this just a similar pump and dump from offshore investors looking for a segment to profit from? Monero is the cryptocurrency used for illegal darknet purchases because of its privacy, which takes significant effort to break (primarily entities running spy nodes and being involved in multiple transactions with the target, mostly alleviated by running your own node). And since the OCGFC don’t want you having any financial privacy, Monero is being made illegal in the EU next year as well as many other countries. Other than Bitcoin, it’s one cryptocurrency I like and value having used it to pay anonymously for my Mullvad VPN service, as well as running a Monero node.

https://coinmarketcap.com/community/articles/696660f5dd2f2668d5ae7f75/

By CFU

Key Insights

- Monero surges beyond $ 592, as investors shift towards privacy-focused resources amid global crypto regulation crackdowns.

- The technical indicators have noted a high upward trend with XMR trading within an upward trend in a bullish channel, which could break to a new high of $600.

- The trading volume increases by more than 240% in 24 hours, which is an indication of high interest in the market and confidence in the currency by investors.

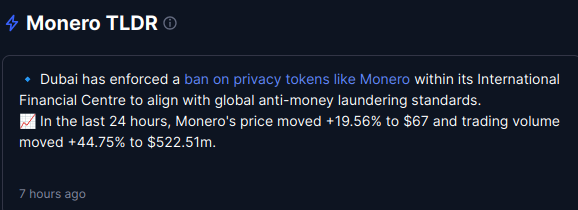

Monero (XMR) has surpassed the value of $592 mark and achieved a new all-time high after high demand and newfound interest in cryptocurrencies based on privacy. The overall crypto market is very stagnant, yet Monero has risen higher than other significant digital currencies with 20% daily returns and 40% growth within the last seven days.

The sharp escalation of Monero’s price has been prompted by the rising demand for privacy-related tokens. The pressure of regulation in various jurisdictions has led to a change in the moods of the investors, and Monero has become a better choice compared to other privacy coins such as Zcash. This trend has caused a massive inflow of capital, which has made XMR even stronger in the market.

Technical Indicators Affirm Strength

Market indices are favorable to the upward movement. Monero is still trading in a sharp upward pattern. It has the lower frame acting as dynamic support, and the upper limit of approximately $600 is the immediate resistance level. Breaking above it may cause a further increase to reach $650. There is, however, the risk of a fall to the 550 support level, where the prices will be nearer to the 500 mark.

Monero volume of trading has grown by over 240% in the last 24 hours, and it is currently at approximately 347 million. This is a volume growth that means that there is greater market involvement and investor confidence. The MACD indicator shows that the MACD line is still on a bullish trend, where the distance between the MACD and the signal lines is larger. The Relative Strength Index stands at 81, and this implies a high buying power.

Comparison of the market performance

Although Monero has grown considerably, the rest of the cryptocurrency market is quiet. Bitcoin has registered some slight recovery as the coin is trading at slightly above 91,000. Ethereum has held above $3,100. Monero has performed significantly better than its competitors, even though the performance of the broader market has not moved a lot.

Since late last year, privacy tokens have shown resilience. Although Zcash had attracted notable attention in Q4, Monero’s steady upward trajectory has placed it at the forefront of the privacy segment. With regulatory scrutiny increasing worldwide, Monero continues to benefit from renewed focus on decentralized financial privacy.