There are other reports, but the $3-4 billion in BTC is supposedly coming from Back’s own stash of Bitcoin which he is selling to the operation. And you can see that he’s all in with the traditional finance bankers, and why he’s out being pimped for Bitcoin Core v30 and blowing up OP_RETURN. He’s a co-conspirator in damaging and taking over Bitcoin as he was brought into the billionaire fold.

Consequently, I was thinking the Taproot bug they’ve left for two years blowing up the UTXO database is a purposeful attack on nodes in regard to Luke DashJr’s mining operation to save Bitcoin from mining pool centralization, because individual miners create their own blocks with their own rules in his OCEAN pool, and this depends on holding the entire UTXO set in memory of the miner’s node to be competitive, which requires a computer with a lot of memory. As I believe it’s 13 GB on disk compressed, but as much as five times that in memory. If they can add to this with blowing up OP_RETURN, they’ll weed out small node runners to the point they can get away with doing just about anything they want with Bitcoin in changing the protocol and exercising more control with mining. So it looks like we’re heading to a soft fork to see if the Bitcoin user community around the world can take back control from the corporations being used to corrupt and take over Bitcoin, or the bankers win and make Bitcoin their own heading towards node centralization.

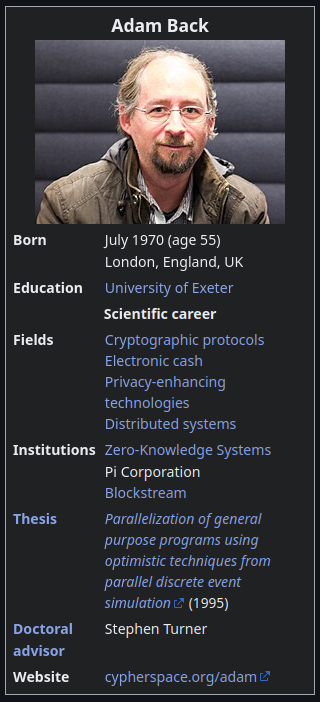

And Adam Back’s Wiki page is at the bottom below the news article.

https://www.mitrade.com/insights/news/live-news/article-3-968126-20250718

Adam Back’s BSTR plans to go public with 30,000 BTC

Source Cryptopolitan

Jul 17, 2025 15:35

Bitcoin Standard Treasury Company, owned by early BTC contributor Adam Black, has announced it is going public, with more than 30,000 Bitcoins on its balance sheet. Blockstream Capital revealed earlier this week a special purpose acquisition company (SPAC) merger with a Cantor Fitzgerald-backed investment vehicle to purchase billions of dollars in Bitcoin.

The deal will include a purchase of 30,021 Bitcoin’s amounting to roughly $3.5 billion. Back’s company is also expected to be among the top four largest public Bitcoin treasury companies. The Financial Times reported that the Board of Directors from both companies approved the merger, which is expected to finalize in the fourth quarter of 2025.

BSTR plans to expand its BTC acquisition strategy

I am excited to be part of the launch of Bitcoin Standard Treasury Company, led by the incredible @adam3us and his team.

BSTR will merge with $CEPO to acquire ~30K Bitcoin on its balance sheet, which would make it the 4th largest public Bitcoin treasury.@Official_Cantor is…

— Brandon Lutnick (@Brandonlutnick) July 17, 2025

Adam Back later changed the name of Blockstream Capital to BSTR Holdings after the acquisition. Both companies will also raise an additional $800 million, which will make the agreement exceed $4 billion. The deal, which is estimated to reach $10 billion by 2025 after combining purchases from Twenty One Capital, will become one of the largest BTC acquisitions to date.

As the firm expands its Bitcoin accumulation strategy, BSTR’s founder will receive shares in the leading global financial services and real estate service holding company as part of the deal. Back will act as Chief Executive Officer of BSTR, while Sean Bill, an experienced hedge fund investor, will join the firm as Chief Investment Officer.

“By securing both fiat and Bitcoin funding on day one…we are putting unprecedented firepower behind a single mission: maximizing Bitcoin ownership per share while accelerating real-world Bitcoin adoption.”

–Adam Back, Co-Founder and CEO of BSTR.

The company disclosed in the announcement that 25,000 BTC will be contributed by founding Blockstream Capital Partners shareholders, priced at $10 per share. The rest of the BTC will be issued in-kind PIPE priced at $10 per share. The crypto firm also said that revenue from BSTR will be used to acquire additional Bitcoin and establish digital asset products.

BSTR also announced the first PIPE financing with a Bitcoin Treasury merger, with $1.5 billion in fiat financing, SPAC will also pitch in $200 million. The fiat contribution will include $750 million in convertible senior notes, $350 million in convertible preferred stock, and another $400 million of common equity.

BSTR’s co-founder championed Cantor’s support as well as the Bitcoin community’s. He argued that BSTR is being created to bring BTC’s integrity to modern capital markets. The company also confirmed that it intends to provide advisory solutions for companies seeking BTC-based treasury strategies, as well as develop Bitcoin-denominated capital markets.

Companies continue adding BTC to their balance sheet

Brandon Lutnick, chairman of Cantor Fitzgerald, noted that the partnership with Back marks a historic transaction towards integrating the BTC economy and traditional finance. The deal follows a flurry of public companies adding Bitcoin to their balance sheet, an initiative that stemmed from Michael Saylor’s software firm, Strategy’s playbook. Bitcointreasuries.net revealed that there are currently more than 142 publicly-traded companies that hold BTC, worth a combined total of $112 billion.

Cantor Equity Partners also revealed another $3.9 billion planned SPAC acquisition to launch 21 Capital in May, with backing from Tether, SoftBank, and Bitfinex. The firm said the merger would allow it to stockpile around 42,000 BTC and offer investors exposure to the digital asset.

Brandon Lutnick’s firm also raised $200 million in January for a new crypto acquisition company, 21 Capital. The company also announced in March plans to establish a Bitcoin financing business with $2 billion in initial capital to allow investors to use their crypto holdings as collateral.

https://en.wikipedia.org/wiki/Adam_Back

Adam Back

Adam Back (born July 1970) is a British cryptographer and cypherpunk. He is the CEO of Blockstream, which he co-founded in 2014. He invented Hashcash, which is used in the bitcoin mining process.

Life

Back was born in London, England, in July 1970.[1] His first computer was a Sinclair ZX81. He taught himself Basic, and spent his time reverse engineering video games, finding decryption keys in software packages. He completed his A levels in advanced mathematics, physics, and economics.[citation needed]

He has a computer science PhD in distributed systems from the University of Exeter.[2] During his PhD, Back worked with compilers to make use of parallel computers in a semi automated way. He became interested in PGP encryption, electronic cash and remailers. He spent two thirds of his time working with encryption. After graduation, Back spent his career as a consultant in start ups and larger companies in applied cryptography, writing cryptographic libraries, designing, reviewing and breaking other people’s cryptographic protocols.[3]

Cryptography software

Back is a pioneer of early digital asset research similar to Wei Dai, David Chaum, and Hal Finney.[4][5] In 1997, Back invented Hashcash.[6] A similar system is used in Bitcoin.[7][8][9]

He also implemented credlib,[10][better source needed][11][better source needed] a library that implements the credential systems of Stefan Brands and David Chaum.

He was the first to describe the “non-interactive forward secrecy”[12][13][14] security property for email and to observe that any identity-based encryption scheme can be used to provide non-interactive forward secrecy.

He is also known for promoting the use of ultra-compact code with his 2-line[15] and 3-line RSA in Perl[16][17][18] signature file and non-exportable T-shirts[19][20] to protest cryptography export regulations.[21]

Back was one of the first two people to receive an email from Satoshi Nakamoto.[22][2] In 2016, the Financial Times cited Back as a potential Nakamoto candidate, along with Nick Szabo and Hal Finney.[23] Craig Wright had sued Back for stating that Wright was not Nakamoto, with Wright subsequently dropping the suit.[2] In 2020, the YouTube channel Barely Sociable claimed that Back is Nakamoto. Back subsequently denied this.[24]

Back has promoted the use of satellites and mesh networks to broadcast and receive bitcoin transactions, as a backup for the traditional internet.[25]

Business career

On 3 October 2016, Back was appointed as CEO of Blockstream.[26]