It would seem they maybe reached a 34% mining attack though some crypto news sites claim they accomplished a 51% attack. Some speculate we’re entering an altcoin bull market, and attacking Monero, a real privacy coin, is about pushing alternatives. And it could be a larger effort to diminish Monero adoption and confidence as governments don’t like privacy coins they can’t track. Of interest, Qubic membership has voted to attack Dogecoin next, but they’re still mining XMR as it will require some software retooling. And they haven’t been able to reorg the XMR blockchain for a while, so that would support a couple scenarios, e.g. they lost miners converting to XMR directly, or they were renting hashrate and have stopped due to the expense probably having been content with claiming a successful 51% attack, though not directly proving it. Looking at X posts, Qubic and its supporters seem to be a trash operation trying to claw some significance for their own financial gain through deceptive marketing and propaganda. The positive takeaway, is the developers of Monero are working on improvements to limit this type of attack in the future.

https://invezz.com/news/2025/08/18/xmr-rebounds-16-as-miners-neutralize-qubics-51-attack-on-monero/

Written by Newton Gitonga

Edited by Deepali Singh

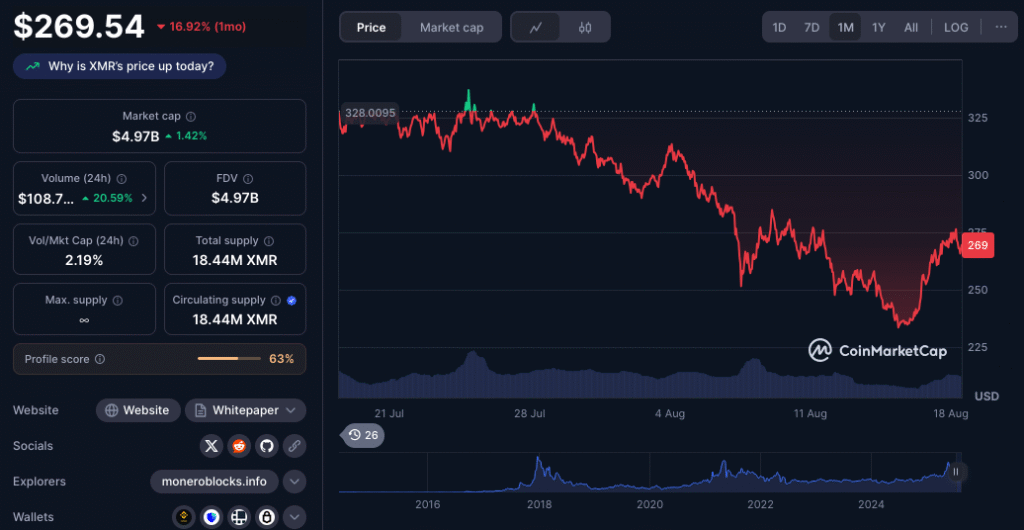

- The altcoin gained over 16% from Friday’s low as miners restored network balance.

- Qubic’s hashrate share plunged, reducing concerns over a lasting 51% attack.

- XMR remains bullish amid broader market dips.

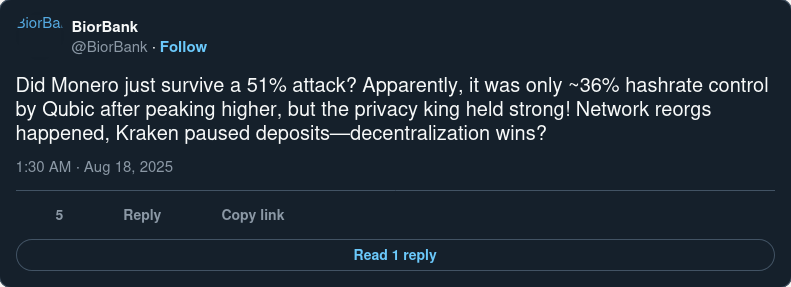

The largest privacy-centric cryptocurrency, Monero, faced a crucial test on its decentralization last week after Qubic seized control of the ecosystem.

XMR exhibited bearishness amidst the hashrate capture.

Fears of double-spending, network rewrites, and censorship saw trading platforms like Kraken suspend Monero deposits.

However, the token staged an impressive comeback over the weekend.

It soared over 16% from around $243 on Friday to today’s intraday peak of $272.

XMR’s bounce-back materialized after Monero miners reversed Qubic’s hashrate dominance.

MiningPoolStats data shows Qubic’s share has plunged to around 35%.

Why Qubic’s control sparked concerns

The trouble began when Qubic announced experimental plans to take over the Monero blockchain to demonstrate its capabilities.

The mining entity managed to control over 50% of Monero’s hashrate.

Consequently, it surpassed the 51% threshold, considered the line between potential vulnerability and ecosystem safety.

Such control brought fears that Qubic could reorganize transactions and block other participants from authorizing them.

That signaled centralization – against Monero’s core decentralization and privacy ethos.

The development sparked considerable selling momentum last week, with the community reacting to a potential prolonged takeover.

However, Monero miners didn’t take long to strike back.

XMR miners retaliate

Fortunately, Monero’s ‘crisis’ didn’t persist. Independent pools and miners reacted quickly to thwart Qubic’s dominance.

That involved amplifying activity and redistributing XMR hashrate across the network.

Qubic’s mining share plunged to around 35% within days, easing concerns about prolonged dominance with restored balance.

XMR price turned bullish after the recovery as miners’ pushback reassured the community.

The move confirmed that Monero boasts a strong decentralized participant base, willing to defend the blockchain against unwanted power control.

The response fueled the latest rally as the community gained trust in the ecosystem’s resilience.

XMR price outlook

Monero is among the few tokens with bullish sentiments today.

While bears rattle the broader market, XMR has extended weekend gains by an over 4% uptick in the past 24 hours.

It trades at $272, with a 45% trading volume increase signaling renewed interest.

However, prevailing market sentiments will shape XMR’s trajectory in the coming sessions.

Extended selling activities will mean short-lived recoveries for the altcoin.

The markets remain cautious ahead of the Federal Reserve chair’s speech on August 22.

Bears dominate the crypto landscape as 24-hour liquidations approach $500 million.

Bitcoin has lost the crucial foothold at $116,960 after losing over 2% in the past day to $115,430.

BTC requires massive buying pressure and enhanced sentiments to prevent declines to the support around $110,000.

Continued broad market downtrends will likely delay Monero’s current recovery.

Meanwhile, analysts believe the current dips represent the final shakeout before solid bull runs to record highs in the coming months.