An interesting article on Bitcoin’s supply being fixed (article at bottom). And my article on Bitcoin covers the consensus of people running the software that sets the version. And of the 67,000 nodes, 19,000 active, I run two, a Raspberry Pi 5 and Pi 4 that are always active unless being updated (currently Raspiblitz with 2 TB drives for longevity and if you hold Bitcoin you should run your own nodes for submitting transactions and wallets to access for maximum privacy). And most people running nodes also hold Bitcoin and aren’t going to devalue their holdings by running a new software version inflating Bitcoin quantity. Consequently, Bitcoin Cash tried to fork the code years ago, but the consensus stayed with Bitcoin Core, and probably most of us cashed out our Bitcoin Cash and reinvested it back in Bitcoin (you can make free money with a large enough fork, so don’t worry about people trying to hijack it).

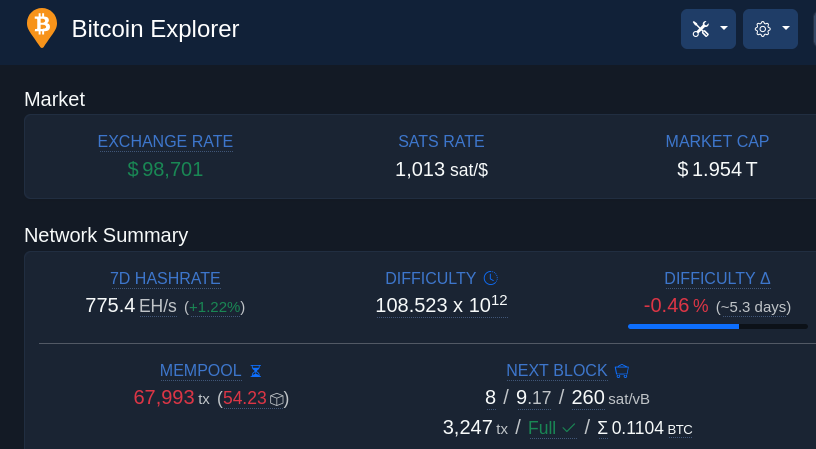

Of course, there is one issue with the Bitcoin price going up, and that’s the ability of it to be split into small transactions. Bitcoin’s smallest division is a satoshi, with $1 being worth 1,013 satoshis at the current price of $98,701. Since Bitcoin is deflationary, it will continue to go up with time and has already been above $100,000. So this division level might have to be adjusted in the future. Also it’s possible there could be a change to double everyone’s Bitcoin holdings to introduce more without changing the effective price of people’s holdings (kind of like a stock split). Consequently, there is also development on settlement layers that exist on top of Bitcoin that could address this issue as well. But as Bitcoin is distributed around the world with many regular people running their own nodes, changing consensus isn’t as easy, which Bitcoin Cash can attest to. And if a nation state started an attack in this regard, a lot of people would start setting up more nodes which is pretty easy to do on minimal hardware.

https://thedeepdive.ca/is-bitcoins-supply-actually-fixed/

By ER Velasco

Bitcoin is often lauded as the first truly decentralized digital currency, with its capped supply of 21 million coins serving as a cornerstone of its appeal. However, this assumption came under scrutiny recently when BlackRock, the world’s largest asset manager, released a promotional video highlighting Bitcoin’s features.

Amid glowing praise for Bitcoin’s monetary policies, a disclaimer caught viewers’ attention: “There is no guarantee that Bitcoin’s 21 million supply cap will not be changed.”

This statement, also found in BlackRock’s prospectus for its proposed spot Bitcoin exchange-traded fund (ETF), ignited a firestorm of reactions online. Critics labeled it “misinformation” and “FUD” (fear, uncertainty, and doubt). But what lies behind BlackRock’s cautious wording? Is the 21 million cap really at risk?

A Legal Necessity

The inclusion of the disclaimer in BlackRock’s ETF prospectus stems from legal prudence. According to U.S. Securities and Exchange Commission regulations, all investment risks—no matter how unlikely—must be disclosed to potential investors.

BlackRock’s filing reads: “Although many observers believe this is unlikely at present, there is no guarantee that the current 21 million supply cap for outstanding bitcoin, which is estimated to be reached by approximately the year 2140, will not be changed. If a hard fork changing the 21 million supply cap is widely adopted, the limit on the supply of bitcoin could be lifted, which could have an adverse impact on the value of bitcoin.”

While the possibility of the cap changing is remote, BlackRock’s legal team deemed it prudent to highlight this hypothetical scenario.

Exceeding the 21 Million

There are two primary ways Bitcoin’s supply could theoretically increase: a critical bug or a voluntary hard fork.

Bitcoin’s code has not been immune to errors. The most notable example occurred in August 2010, during the network’s infancy. Known as the “value overflow incident,” this bug briefly inflated Bitcoin’s supply to over 184 billion coins. Satoshi Nakamoto, Bitcoin’s enigmatic creator, resolved the issue within hours.

Since then, Bitcoin has operated without similar inflationary issues. Nevertheless, BlackRock’s filing points out that “it’s technically possible that someone might exploit an esoteric bug in the future and briefly alter its supply.”

This perspective reflects the reality of software vulnerabilities, particularly in systems as valuable as Bitcoin. With over $1.8 trillion in market capitalization, any bug that enables the creation of new coins would pose a significant threat to the network.

The second scenario is a voluntary change to Bitcoin’s supply cap through a hard fork. Bitcoin’s current rules, enforced by a global network of nodes, set the maximum supply at just under 21 million coins—20,999,817.31308491 BTC to be precise.

However, BlackRock’s prospectus acknowledges the possibility of a hard fork that could alter this rule. One potential justification for such a fork involves a proposal known as “tail emissions.” This concept suggests creating small, perpetual rewards for miners after the final Bitcoin is mined around 2140. Some versions of this idea propose recycling unspendable Bitcoin, while others suggest increasing the total supply slightly to incentivize miners to continue securing the network.

Despite these discussions, the likelihood of such a change remains slim. As BlackRock’s disclaimer notes, “many observers believe this is unlikely at present,” a sentiment echoed by most within the Bitcoin community.

Network’s Defense Mechanism

Bitcoin’s supply cap is more than just code; it is a social consensus enforced by the network’s participants. Currently, there are at least 67,000 Bitcoin nodes worldwide, of which approximately 19,000 are online at any given time.

These nodes collectively enforce Bitcoin’s rules, rejecting any block or transaction that violates the 21 million cap. This decentralized architecture ensures that any attempt to increase Bitcoin’s supply would require overwhelming support from the community—something that has consistently been absent in previous discussions.

“There will never be more than 21 million bitcoin,” is a refrain echoed by Bitcoiners.

For Bitcoin maximalists, the supply cap is sacrosanct. BlackRock’s disclaimer, however, reflects the cautious lens through which institutional investors view Bitcoin. From a legal standpoint, the asset manager’s acknowledgment of this remote risk is not an indictment of Bitcoin’s design but a compliance-driven measure to inform investors.

As one observer noted, “[BlackRock’s lawyers] would still prefer to note the risk — even if it is in fine print.”