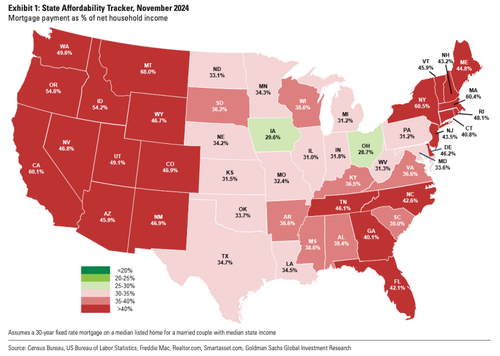

Looking at the map of affordability (bottom) by percentage of income required to purchase a home, you can certainly see where Californians fleeing have impacted the entire west. And for some reason a lot moved to Tennessee, which was reported as being the most Christian state at one time. But Tennessee has major urban areas with one being the train wreck that is Memphis, where you can watch a lot of criminals trying to evade the Arkansas State Troopers back across the bridge on Police Pursuits.

https://www.zerohedge.com/markets/goldman-delivers-grim-outlook-prospective-homebuyers

By Tyler Durden

Goldman’s latest note to clients offers little optimism for resolving the housing affordability crisis in 2025. Mortgage rates are expected to remain elevated while housing prices trend at record highs, further exacerbating challenges for prospective buyers and likely keeping many on the sidelines.

“Our mortgage strategy team’s expectations rates will hold in the low-to-mid 6% range” next year, said analysts Susan Maklari and Charles Perron-Piche, adding, “This will keep existing home sales 24% below the 2015-19 average.”

They offered clients the understanding that there would be no meaningful relief for prospective buyers as the affordability crisis will linger through next year:

“Despite our macro team predicting another 125bps of Fed rate cuts through September 2025, our credit strategy team forecasts the 30-year fixed mortgage rate will end 2025 at 6.3%, down just 30bps from 6.6% anticipated at the end of this year and only 39bps below current levels.”

Given the latest inflation data, a largely in-line CPI report followed by a ‘red hot‘ PPI print in November, this data suggests that longer-term yields are to stay higher over the medium- to longer-term, according to Bloomberg’s Simon White.

In other words, White suggests that this inflation data squashes the dovish party. As of late Thursday, the market is pricing in only two rate cuts for next year.

Goldman analysts noted that without interest rate relief and the general leanness of housing inventory, home prices are forecasted to increase by 3% YoY.

“Said differently, we estimate the mortgage payment on a median-priced single-family home is 35% of the median household income. Although this is down from 39% a year ago, it remains well above the 30% threshold for most lenders,” they explained.

The analysts then provided clients with a state affordability tracker for the last month.

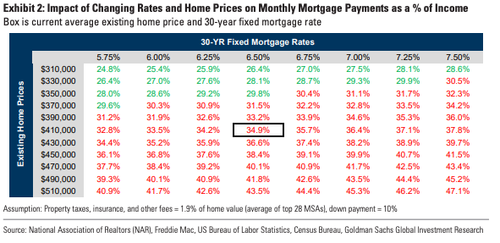

Impact of Changing Rates and Home Prices on Monthly Mortgage Payments as a % of Income

“The affordability headwinds will be most pronounced on resales, with existing home transactions holding at 4.1mn in 2025 vs the 2015-19 average of 5.4mn. This reflects the lock-in effect, which we believe will remain a headwind for the next several years,” the analysts said, adding, “Homeowners would be reluctant to move even if rates declined to the high-5% range.”

Goldman has delivered some grim news for prospective homebuyers sitting on the sidelines: the affordability crisis is nowhere near being resolved.