Getting rid of income taxes:

JOE ROGAN: “Did you just float out the idea of getting rid of income taxes and replacing it with tariffs? — Were you serious about that?”

DONALD TRUMP: “Sure, why not?” pic.twitter.com/VGLbUdk8j8 — America (@america) October 26, 2024https://www.zerohedge.com/political/watch-trump-and-rogan-have-wild-interview

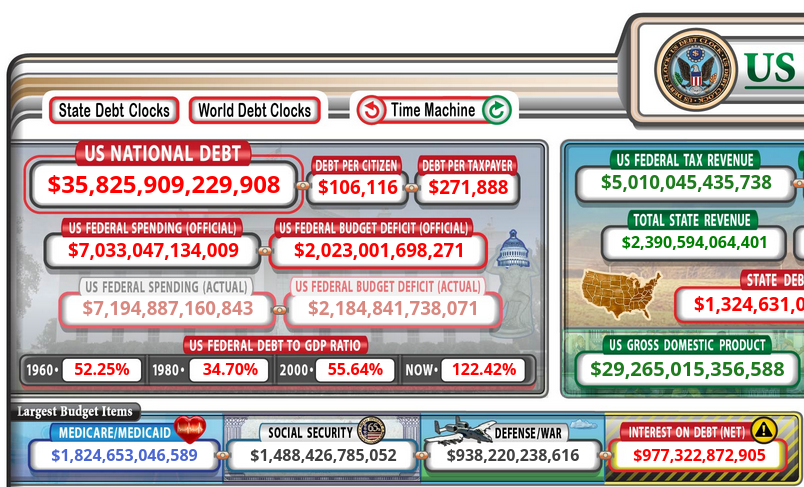

This is so ridiculous that you’d think the Demonrats would propose it. The numbers just don’t work, and the financial state of our country is so dire, we can’t afford to cut any taxes. It’s actually so bad, there is no way out of it except for a major financial crash lowering the debt by devaluing its worth, along with the dollar and all of our savings and investments. Consequently, that’s been happening a bit already with high inflation because of their bad monetary policy. But pay attention below to the deficit and how interest payments are now more than military spending, both eclipsed by Medicare/Medicaid and Social Security expenses. And see what the debt load is per citizen and taxpayer. And not all that much is manufactured in this country with megacorps spread around the world, e.g. my 2003 Ford Ranger 4×4 was assembled here, but the transmission was assembled in Germany, with the engine assembled in France, and who knows where all the parts came from. Even if you could make this work, tariffs would just cost Americans more when purchasing, probably eclipsing what they paid in income taxes. Not to mention, this would never happen. Begs the question though, why say such a ridiculous thing when you are already doing so well? Perhaps this resonates with the truly ignorant in our society that previously voted for Demonrats?

https://econofact.org/factbrief/is-it-realistic-to-replace-the-income-tax-with-tariffs

Is it realistic to replace the income tax with tariffs?

By Keshav Srikant · July 15, 2024

No

The federal government collected about $2.2 trillion in individual income taxes in Fiscal Year 2023 — half of all government revenue. U.S. imports totalled about $3.8 trillion in 2023. Therefore, a tariff rate of 58% would have been required to offset income tax revenue that year — but only if imports remained at this level.

A more realistic scenario recognizes that high tariffs would cause companies and consumers to reduce their purchases of imported goods (as these tariffs would make goods more expensive).

History confirms this: when tariffs have increased in the past, import volumes have dropped as companies and consumers reduced their purchases of imported goods. Fewer import purchases means less tariff revenue.

An analysis by the nonpartisan Peterson Institute for International Economics found that 50% tariffs would maximise revenue. Even so, this would only raise about $780 billion in tariff revenues — far less than the amount raised by the income tax.