When the African Development Bank Group is going to invest $300 million, you have to think it has legs. Perhaps driving adoption and history in other countries will make it more palatable in the west where people are rejecting the notion of digital ID and all that entails? And of course, the OCGFC megacorp Mastercard is behind it as well. Consequently, maybe they’re just trying multiple options to see what sticks and they can propagandize to mass adoption.

https://reclaimthenet.org/mastercards-controversial-digital-id-rollout-in-africa

By Didi Rankovic

One wouldn’t have pegged Mastercard for that corporation that is “driving sustainable social impact” and caring about remote communities around the world struggling to meet basic needs.

Nevertheless, here we are – or at least that’s how the global payment services behemoth advertises its push to proliferate the use of a scheme called Community Pass.

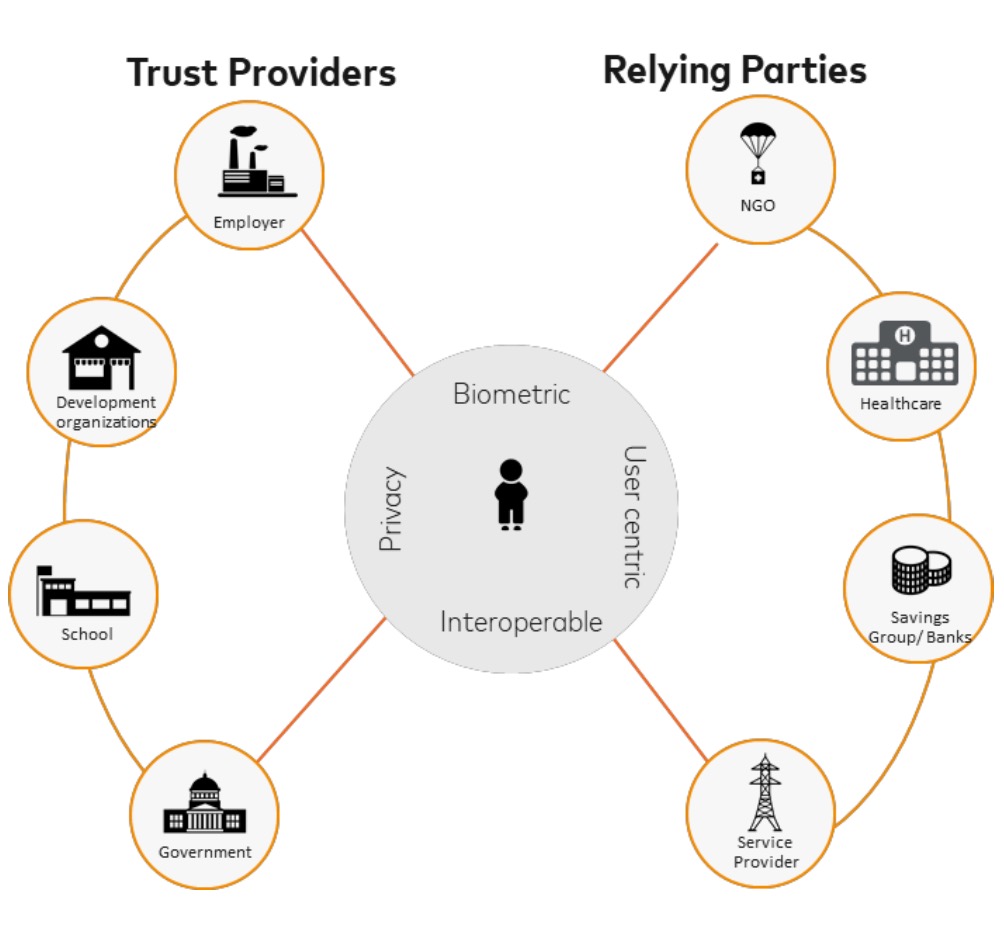

The purpose of Community Pass is to enable a digital ID and wallet that’s contained in a “smart card.” Launched four years ago, the program – which Mastercard says, in addition to being based on digital ID, is interoperable, and works offline – targets “underserved communities” and currently has 3.5 million users, with plans of growing that number to 30 million by 2027.

According to a map on Mastercard’s site, this program is now being either piloted or has been rolled out in India, Ethiopia, Uganda, Kenya, Tanzania, Mozambique, and Mauritania, while the latest announcement is the partnership with the African Development Bank Group in an initiative dubbed, Mobilizing Access to the Digital Economy (MADE).

The plan is to, over ten years, make sure 100 million people and businesses in Africa are included in digital ID programs and thus allowed access to government and “humanitarian” services.

As for Community Pass itself, it aims to incorporate 15 million users on the continent over the next five years. This is Mastercard’s part of the deal, whereas the said it would invest $300 million to make sure MADE happens.

Given how controversial digital ID schemes are, and how much pushback they encounter in developed countries, it’s hard to shake off the impression that such initiatives are pushed so aggressively in economically disadvantaged areas and communities precisely because little opposition is expected.

But MADE is presented as almost a “humanitarian” service itself – there, apparently, solely to make life better, in particular for farmers and women, and improve things like connectivity, financial services, employment rates, etc.

The news about Mastercard’s latest partnership and initiative came from a US-Africa business forum organized by the US Chamber of Commerce.