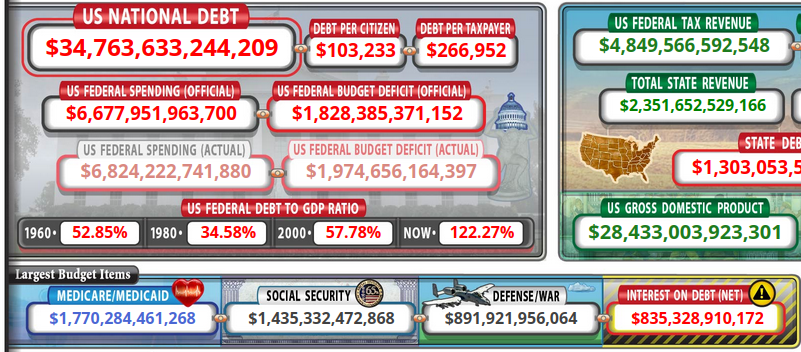

I changed the headline as it wasn’t quite accurate, but there are good facts in the article below. And I always love to highlight the debt clock with debt per citizen and debt per taxpayer, which should severely scare everyone. But it won’t be long before the interest payments to service the debt surpasses defense spending, which is staggering. So, is the plan to just crash the dollar with the greatest depression worldwide making this debt worthless? Or do they have something else like a major world war planned? Perhaps the war after the false peace in Revelation 6 represented by the red horse?

By Anthony Altomari

The United States’ national debt crisis continues to get worse.

The Committee for a Responsible Federal Budget projected that in 2024, the U.S. will spend more on interest payments than national defense.

To put this into perspective, the U.S. spends over $900 billion a year on national defense, which is $600 billion more than the second-highest spender, China, according to the Stockholm International Peace Research Institute, a military expenditure data analytics company commonly known as SIPRI.

Yet, during the first seven months of fiscal year 2024, which began in October 2023, the U.S. Treasury Department calculated that the U.S. had spent $514 billion on national debt interest payments, roughly $16 billion more than we’ve spent on national defense. This makes interest payments the third-highest expenditure for the government, behind Social Security and health programs other than Medicare.

Two years ago, interest was only the seventh largest category, trailing behind Social Security, health programs other than Medicare, income assistance, national defense, Medicare and education, according to Yahoo Finance.

Interest payments have skyrocketed in the last few years. By the end of 2024, the CRFB said interest payments are projected to reach $870 billion, which is 152 percent higher than they were at $345 billion in 2020.

The CRFB indicated that spending on interest this fiscal year is more than all of the money spent on veterans, education and transportation combined, and estimated that, at this rate, the U.S. will spend more on interest than any other category by 2051.

“Rising debt will continue to put upward pressure on interest rates. Without reforms to reduce the debt and interest, interest costs will keep rising, crowd out spending on other priorities, and burden future generations,” the CRFB said.

The interest payment problem has been compounding for a number of years, largely due to the government’s inability to slow down the growth of the national debt and rising interest rates.

Erratic government spending has led to the U.S. consistently running annual deficits, which has ballooned the national debt to $34.6 trillion, according to Yahoo Finance.

The federal deficit averaged $138 billion in the 1990s. It grew slightly in the 2000s, averaging around $318 billion. The 2010s saw the average debt more than double to $829 billion. But, since 2020, the annual deficit has averaged over $2 trillion, with pandemic-era spending initiatives largely to blame.

The Congressional Budget Office has projected the 2024 deficit to be $1.5 trillion. Between 2025-2034, the CBO projects that the U.S. will run a total deficit of $20 trillion, which averages to about $2 trillion a year.

Unfortunately, it’s nothing new for the U.S. to be running a deficit. According to Statista, the U.S. hasn’t had a budget surplus since 2001.

The annual deficit, as a percentage of GDP, has also almost doubled in the last 10 years, going from 2.8 percent of GDP in 2014, to a projected 5.3 percent in 2024, Yahoo Finance said.

Besides the growing deficit, the average interest rate paid on Treasury securities has also risen in the last few years, as the Federal Reserve has increased interest rates in the hope of stymieing inflation. The average interest rate in April 2024 was 3.3 percent, Yahoo Finance reported.

So, not only does the U.S. now have more debt to pay off, but interest rates are also at their highest level in 15 years.

This is a problem that all Americans should be concerned with.

Those in Washington do not see the importance of getting our debt under control. Without fiscal responsibility, the debt crisis will only continue to get worse, and will put the U.S. in jeopardy of defaulting on its loans, which could destabilize the world economy.

If the most powerful country in the world can’t pay its debts, it could lead to serious financial consequences. Not only would the U.S. become a financial pariah, but the value of the dollar could plummet, which would negatively impact all Americans.

But neither President Joe Biden nor former President Donald Trump, the two front-runners in this November’s election, has put forward a concrete plan on how they will tackle the national debt crisis.

Biden proposes to raise taxes on the wealthy, which he argues will provide suitable funds to start seriously chipping away at the debt. At the same time, Biden wants to increase spending, particularly on social programs, which could wipe out any savings his plan would create.

Trump, on the other hand, wants to increase tax revenue by encouraging more oil and national gas drilling, which could be utilized to fight the debt crisis. Still, Trump wants to lower taxes, which could again offset any payments towards the debt.

Granted, the solution to the debt crisis is not something that can be fixed short-term by either man. It will likely be something that Americans today will have to deal with for the rest of our lives.

Yet, if we continue to spend more of our money on interest payments with no end in sight, instead of investing in areas such as education and infrastructure, what kind of future will we leave our children?

The government can start by taking small steps on the road to fiscal responsibility. Cutting federal spending, be it the national defense budget or social programs, will free up money to tackle the debt in the immediate.

This entails being more aggressive toward the debt in the short term so that our nation can prosper in the long term, which some may not be on board with.

However, we have to start getting the debt under control at some point, and if we keep ignoring the problem, we could ruin the future of our nation.