According to my Bitcoin node BTC Explorer, we’re just 4 days and 8 hours away from the Halving. This is a reduction of new BTC being rewarded to miners with each new block, going from 6.25 to 3.125 BTC along with transaction fees. This block reward is meant to sustain the network as it grows until such a time as the network is established and transaction fees can sustain miners alone. With miners running the mining equipment with the expense of power and equipment it is similar to how new gold is mined and limits the new creation of gold. Consequently, with such a reduction of new BTC being available along with ETF demands, we should get a significant price increase. And if you need a primer on what Bitcoin is and why it has value check out this post.

Authored by Zoltan Vardai via CoinTelegraph.com,

The potential approval of the first batch of spot Bitcoin exchange-traded funds (ETFs) in Hong Kong could be a big catalyst for Bitcoin’s halving rally, commentators say.

Hong Kong could approve 4 Bitcoin ETFs before halving

The Securities Regulatory Commission of Hong Kong (SFC) could approve the first batch of spot Bitcoin ETFs by April 15, days before the Bitcoin halving is set to cut the supply issuance rate of BTC.

The Hong Kong regulator has reportedly accelerated the approval process for four spot Bitcoin ETFs, according to local news media reports. The potential approval could attract more buying demand for Bitcoin, by offering BTC exposure to both retail and institutional investors in Hong Kong.

Hong Kong regulators could approve both Bitcoin and Ether ETFs on April 15, according to crypto entrepreneur and investor Lark Davis, who wrote in an April 12 X post:

“Hong Kong likely to approve BOTH Bitcoin and Ethereum spot ETFs as soon as Monday! China is about to start bidding the same week the Bitcoin halving is happening!”

It will take approximately two weeks to finalize ETF listing procedures on the Hong Kong Stock Exchange, after the securities regulator greenlights the initial set of spot Bitcoin ETFs.

Can ETFs spark Bitcoin’s post-halving bull run?

The approval of the first spot Bitcoin ETFs in Hong Kong could catalyze Bitcoin’s post-halving rally, according to Herbert Sim, chief operating officer of crypto exchange Websea, who told Cointelegraph:

“Halving is not the only thing to look out for in the price action. But rather the upcoming Bitcoin ETF approval in Hong Kong, which also happens next week. The big banks of China will all have to start buying Bitcoin themselves too.”

Sim noted that Hong Kong-based ETFs will only add to the institutional demand and inflows created by large U.S. ETF issuers such as BlackRock, which he expects to continue. He added:

“And with this supply cut from the Bitcoin Halving, prices will definitely soar.”

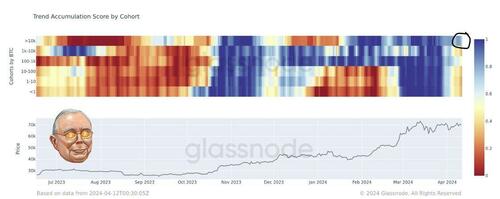

Large investors, or so-called mega whales, that are holding at least 10,000 BTC are accumulating Bitcoin at the current price level, in anticipation of next week’s approval, according to popular crypto commentator Bitcoin Munger’s April 12 X post:

“The only cohort that is net-accumulating Bitcoin is the largest whales (>10k). Just ahead of Hong Kong ETF approvals and the halving. A positive contrarian signal if I had to guess.”

Trend Accumulation Score by Cohort. Source: Bitcoin Munger

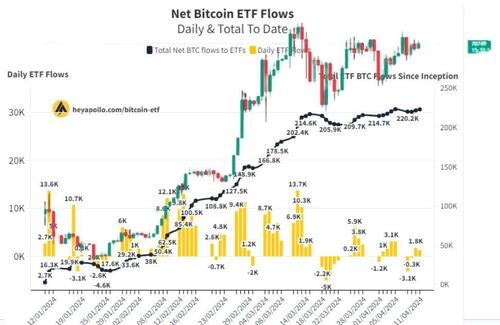

ETF inflows have been a significant part of Bitcoin’s price rally. By Feb. 15, Bitcoin ETFs accounted for about 75% of new investment in the world’s largest cryptocurrency as it surpassed the $50,000 mark, according to CryptoQuant research.

Net Bitcoin Flows, Year-To-Date Chart. Source: Thomas Fahrer

Bitcoin’s price action has been closely correlated with the net Bitcoin ETF inflows, according to Thomas Fahrer, the co-founder of Apollo, who wrote in an April 12 X post, referencing the chart above: “I would have thought it was extremely obvious that ETF flows are driving Bitcoin [price]…”