Smart Argentines with capital are starting to put money in Bitcoin to protect themselves from their currency dropping in value against the dollar. As economic conditions around the world worsen, there will be a lot of people looking to store value in Bitcoin to protect against capital loss from their fiat currencies being devalued, increasing demand and the price of Bitcoin. And the halving in block rewards is about 3.9 weeks away, with the block reward being cut in half there will be less new bitcoin being mined with each block (from 6.25 to 3.125 new Bitcoin per block), reducing supply of new bitcoin being introduced into the system. The block reward of new Bitcoin was designed to support miners until such a point where transaction fees alone would be profitable enough to run mining equipment, and has been working as designed. Usually at the halving the price of Bitcoin increases to make the block reward profitable even though reduced. The data for the last mined block is below.

A total of 7,625.15 BTC ($499,369,753) were sent in the block with the average transaction being 2.7758 BTC ($181,786). Unknown earned a total reward of 6.25 BTC $409,311. The reward consisted of a base reward of 6.25 BTC $409,311 with an additional 0.1273 BTC ($8,336.85) reward paid as fees of the 2,747 transactions which were included in the block.

https://www.blockchain.com/explorer/blocks/btc/836120

https://www.zerohedge.com/crypto/bitcoin-demand-argentina-surges-two-year-highs

Authored by Ciaran Lyons via CoinTelegraph.com,

Bitcoin remains in demand among Argentines as the ARS has lost fourfold value against the US dollar in the last year, dropping from 0.0049 USD per ARS in March 2023 to 0.0012 USD at present.

Argentines’ efforts to preserve their savings amid the ongoing decline of their national currency, the Argentine peso (ARS), has resulted in the nation recently hitting its highest demand for Bitcoin in 20 months, according to a recent report.

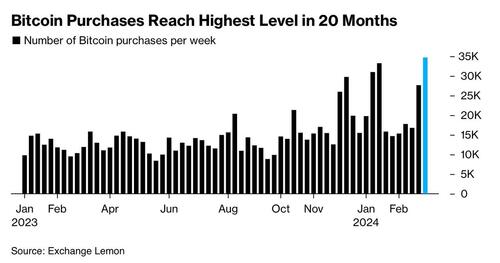

On March 20, Bloomberg reported data sourced from cryptocurrency exchange Lemon Cash revealing nearly 35,000 customers in Argentina purchased Bitcoin in the week ending March 10, which is double the weekly average compared to 2023.

Bitcoin purchases in Argentina Jan 2023 – March 2024. Source: Bloomberg

A major factor for the increase in demand is the ongoing decline of the nation’s currency.

Over the past twelve months, the ARS value against the US dollar has plummeted, dropping from 0.0049 USD per ARS in March 2023 to 0.0012 USD at the time of publication.

However, it was noted that Lemon wasn’t the only platform seeing a surge in demand. Other major exchanges in Argentina, such as Ripio and Belo, reported similar trends.

According to the CEO of the digital wallet Belo, Manuel Beaudroi, stablecoin purchases in Argentina declined from 70% to 60% as Bitcoin’s recent price surge attracted more interest.

“The user decides to buy Bitcoin when they see the news that the currency is going up, while stablecoin is more pragmatic and many times used for transactional purposes, as a vehicle to make payments abroad.”

He also claimed that Belo has seen volume in Bitcoin and Ether increase “tenfold so far in 2024 compared to the same period last year.”

However, a recent report suggests that interest in stablecoins might still exist, as Argentines are possibly choosing not to use the well-known exchanges within the country for purchasing them.

On Feb. 12 Cointelegraph reported that Argentines are using black market exchanges, known locally as “crypto caves,” to buy USD stablecoins in an effort to escape strict currency controls and the rising inflation of the ARS.

Meanwhile, the use of digital currency for specific transactions is slowly gaining traction within the country.

In December 2023, Diana Mondino, the minister of foreign affairs, international trade and worship, claimed that a decree aimed at economic reform and deregulation would allow the use of Bitcoin and other cryptos in the country under certain conditions.

Following the ruling, a local landlord and a tenant in Rosario, the third most populated city in Argentina, sealed a rental agreement where the latter would pay monthly rent in Bitcoin.