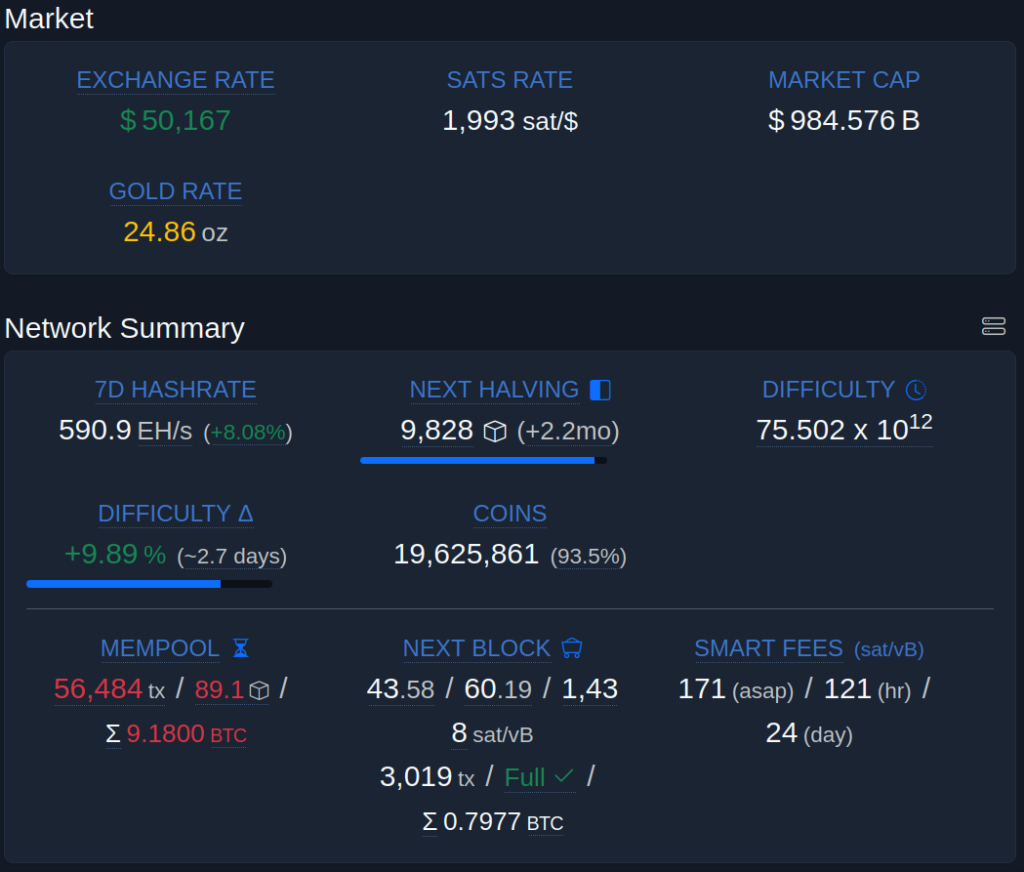

According to this article there is a lot of ETF inflow and institutional accumulation, but there is a crypto lender in bankruptcy with $1.6 billion of GBTC to be liquidated in the next few months which will damper things eventually. And worth noting OCGFC Blackrock with trillions of OCGFC capital under investment has their own Bitcoin ETF now. Consequently, we’re just 2.2 months away from the next halving where the block reward will be halved. Usually there is a major price move after a halving as there will be fewer new Bitcoin being added into circulation with every new transaction block (eventually block rewards will cease to exist and transaction fees alone will support mining new transaction blocks – see my Bitcoin explanation for more info on what a fabulous protocol Bitcoin is and why it has value). And you can see in the chart below there has been a major spike in trading volume with the move this morning. It could also be a pump and dump to wreck and profit off all the traders trying to maximize profits using leverage (credit).