We’re still not to the crash, but that’s a lot of money flooding into Bitcoin. At present the Bitcoin price has jumped up to $39,698. And there were reports that these investors were moving Bitcoin off the trading platforms to secure storage (not your keys, not your Bitcoin). Consequently, it’s going to be interesting in the crash to see how much money is diverted away from gold to Bitcoin as a safe haven to store capital as the financial system collapses and a new one based on gold is formed between nations. And if you don’t know the value of Bitcoin, you have to understand it as a protocol for trustless exchange based on cryptography with no central authority that can manipulate transactions or print more Bitcoin, so it derives it’s value as a transaction platform similar to VISA or MasterCard where it’s value is similar to their stock evaluations. And it’s also a distributed system around the world outside the reach of governments who can only place controls and restrictions on on-ramps and off-ramps.

https://www.zerohedge.com/crypto/cryptos-soar-after-largest-inflows-two-years

By Tyler Durden

Anticipation of an eventual US spot Bitcoin ETF – which Bloomberg’s analysts assign a 90% probability of being approved by the SEC in January…

Okay, we’re nearing in on deadline dates for 3 spot #Bitcoin ETF applications. I want to get ahead of it because there’s a pretty good chance we’ll see delay orders from the SEC. Delays WOULD NOT change anything about our views & 90% odds for 19b-4 approval by Jan 10, 2024 pic.twitter.com/LE7sOlHAHM — James Seyffart (@JSeyff) November 14, 2023

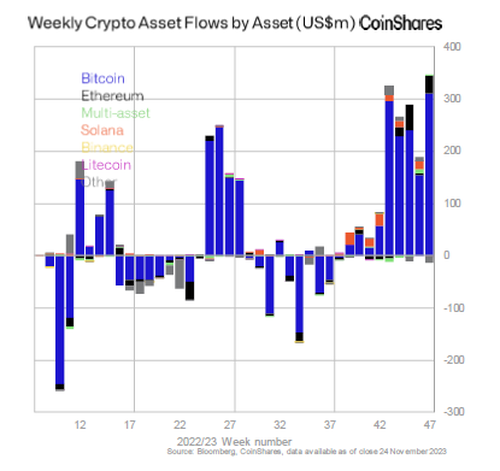

… as well as surging prices, have helped to spur inflows into digital-asset investment products for a ninth consecutive week, the largest run since the crypto bull market in late 2021.

According to a recent report from CoinShares, these products which include trusts and exchange-traded products, saw inflows of $346 million last week, with Canada and Germany contributing to 87% of the total. Only $30 million came from the US, a sign of continued low participation from the country, the asset-management firm said. Of course, that will change as soon as investors start seeing double digit percentage weekly gains, and reallocating their money into crypto in droves, just like they did in 2020 and 2021.

Since early October, the crypto market has surged as traditional asset managers like BlackRock prepared for spot Bitcoin ETFs, potentially bringing in many more investors into the asset and resulting in inflows of tens of billions in fresh capital.

“The combination of price rises and inflows have now pushed up total assets under management to $45.3 billion, the highest in over one and half years,” the report said.

Bitcoin products raked in $312 million last week, pushing inflows to over $1.5 billion since the start of the year. Ether products saw $34 million in inflows last week, almost negating outflows all of 2023.

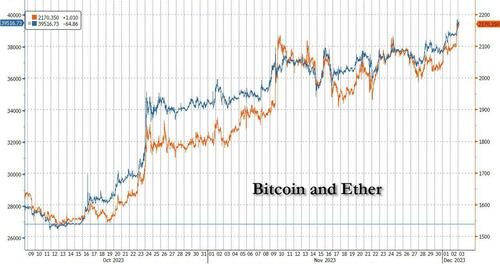

Amid the surging inflows, and amid expectations for imminent ETF approval by the SEC and a surge in March rate cuts odds, bitcoin and ethereum have continued their furious ascent, with the former now trading just shy of $40,