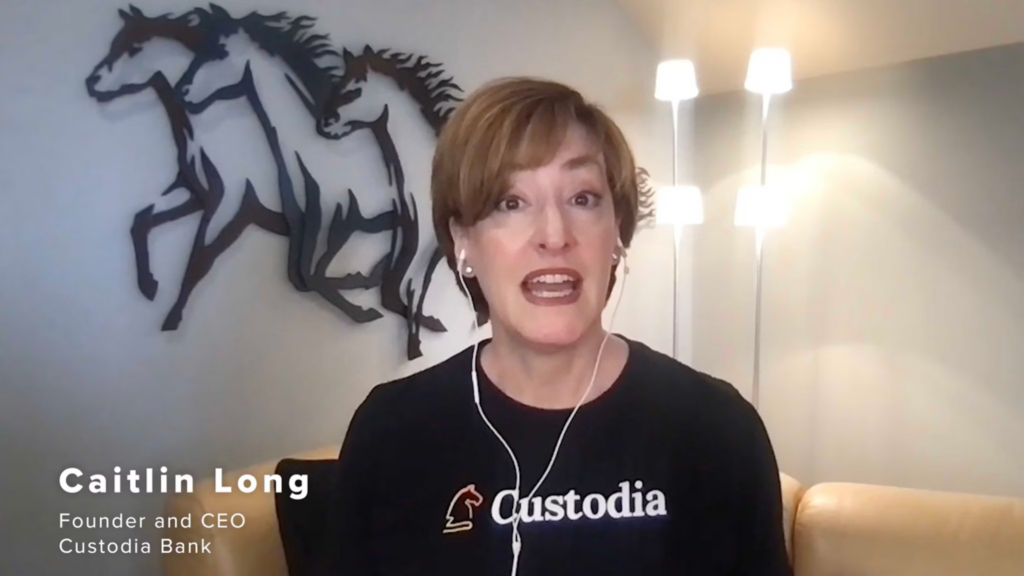

Nice write up on the politicization of banking using high risk and insurance costs. And it’s a nice commentary on Wyoming that they’re open to new forms of banking done with reasonable regulatory oversight. And Caitlin Long of Laramie, WY, was a former investment analyst that came to recognize how powerful the Bitcoin protocol was.

By Renée Jean

While continuing to fight the Federal Reserve in court, Custodia Bank CEO Caitlin Long has opened two services at the Wyoming-based digital bank that digital asset industries are clamoring for — money market mutual funds and dollar deposits.

The Federal Reserve has tried hard to buck Wyoming’s digital banks, but Custodia Bank CEO Caitlin Long comes from a state where the motto “Cowboy Up” comes as natural as breathing.

And that she has done, quietly in some cases, like the recent “soft” opening of Custodia Bank last month without fanfare or press release, even as the digital bank continues to fight with the Federal Reserve in court.

“In the banking world there’s really no such thing as a ‘soft’ opening,” Long told Cowboy State Daily. “You’re either open or you’re not. So, we haven’t used that term.”

It would have been a misnomer anyway, Long added, because once the digital asset industry heard that Custodia Bank can now handle money market mutual funds and U.S. dollar deposits, Custodia was inundated with inquiries and new customers from a digital asset industry that now has few regulatory compliant options.

“We got pretty much deluged with inquiries — and congratulations,” Long said. “It’s an industry that’s underserved right now.”

A Quick Pivot

Money market mutual funds were not something Custodia Bank originally planned to do.

“We had to pivot, so to speak,” Long said. “If we had a master account, we would have been providing the payment services, but we’re not an asset manager, so we wouldn’t be doing the money market fund management.”

Custodia Bank sued the Federal Reserve over the rejection of its master account earlier this year. That lawsuit is still pending, Long said, and Custodia Bank has no plan to back down.

At the same time, Long needed to move her business forward lawfully so that it could keep going, and money market mutual funds were a way to do that.

In lieu of having a master account for transactions, Custodia is partnering with other banks to handle that for them. Long declined to identify the bank’s partners, but said Custodia has multiple partners helping it clear transactions.

The dollar deposits, meanwhile, were a “step one” to getting approval for Bitcoin custody, which actually was in the small Wyoming bank’s original plan all along.

“The interesting thing is, because we’re a bank, in order to operate as a bank, we have to take U.S. dollar deposits,” Long said. “That’s a prerequisite. So, we had to get U.S. dollar deposits launched first before we could do Bitcoin custody.”

To accept dollar deposits, Custodia has to meet all the normal requirements set by Wyoming’s state banking charter for Special Purpose Depository Institutions, including being a 100% fully reserved bank. That means it will not do any fractional reserve banking. It will hold 100% of deposits on hand.

But Long also went above and beyond even that.

“There was a whole list of requirements (from the Federal Reserve) that we committed to back in December that we would do,” Long said. “The Fed denied us in January, but we went ahead and did everything anyway because we expect that, ultimately, we’re where the puck is going to be.”

The hockey analogy, Long explained, just reflects that she’s placing Custodia Bank where she expects the industry to land once all the regulatory dust settles.

“The fact that we have partners tells you that there are banks who are still interested in moving forward,” Long said. “They understand this technology is not going away. I think the rest of the industry is going to move toward us, in becoming banks.

“How long that takes, I don’t know … (But) we’re ready to integrate with the Fed. We built everything we needed to do, including what’s called the core program, and the risk-management program for the regional bank style. We have all of those things.”

Chokepoint 2.0 Is Also Live

Long said most digital asset companies have lost banking services in the wake of the collapse of Silicon Valley Bank and Signature Bank, amid a concurrent regulatory crackdown in Washington, D.C., which has seen even lawful customers lose banking services.

“There was a big brouhaha that just happened in the UK with Nigel Farage, where a bank, his longtime bank, closed his account because he was deemed ‘too high risk,’” Long said. “So yes, that is happening across the board, and it’s happening to Wyoming industries as well, outside of digital assets.”

Many in the digital asset industry are calling it Chokepoint 2.0, Long said, which refers to the nickname of an effort during the Obama administration to de-bank lawful industries that are unpopular in Democratic circles by labeling them as “high risk.”

“There were 30 different industries that were targeted by bank regulators in Washington, D.C., as ‘high risk,’” Long said. “And a lot of them were Wyoming industries — oil and gas, firearms, ammunition, gaming, adult entertainment, payday lenders — things that were not so-called politically correct industries. There’s no question that this is a round two of that, and the digital asset industry is at the top of the list.”

Long said debanking is not just happening to digital assets.

“I’m still hearing that it’s happening to the firearms industry,” she said. “And by the way, I will say that is an industry that we are willing to serve. I firmly do not believe that banking should be politicized.”

Long said she’s also seen the pressure that’s being applied to the digital asset industry firsthand.

“The regulators will never say you can’t serve the industry, but what they do say is, ‘This is a high-risk industry,’” Long said. “So, if you’re serving it, then you’re going to get extra scrutiny, and you’re going to be deemed higher risk. So maybe your FDIC insurance premiums go up.”

As a Special Purpose Depository Institution, Custodia Bank is a 100% reserved bank, which makes it immune to that particular pressure, Long said.

New York And Wyoming In A Rare Moment Of Alignment

The lack of services for the digital asset industry means Custodia is stepping into something of a vacuum right now. And the fact that they are trying to do everything in a regulatory compliant way has helped them find customers without any problem, Long said.

“A lot of our customers are more interested in the money market fund services right now, because they’re offering higher yield than deposit services, but they need to be able to pay their payroll, they need to be able to pay their vendors, so they need access to payment services in order to do that and we can offer that to them,” Long said.

Long added that it’s interesting that a New York trust company just last week launched a Pay Pal stable coin. Washington, D.C., might be trying to lock down digital assets, but states are pushing back, and she’s proud to be part of that.

“The Fed objected to New York’s approval of that Pay Pal stable coin, but they had no jurisdiction to effectuate that objection,” Long said. “So it is interesting because the state’s are pushing back and, in this example, New York and Wyoming are aligned, even though the Fed is pushing back the digital asset industry is a lawful industry and it cannot de-bank the industry entirely. So what New York did last week put us in good company.”