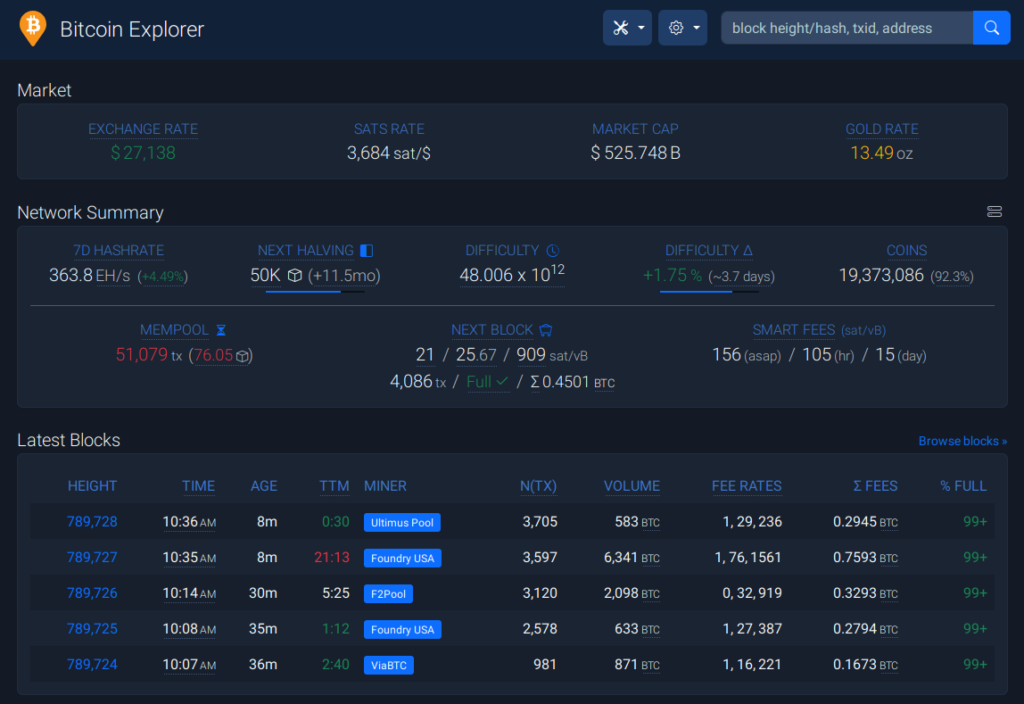

I ran an experiment a couple days ago, putting in a transaction with minimal fee of 1 sat/Byte which was accepted into the mempool. Then I bumped it to 20 sat/Byte which my BTC explorer gave as the fee to get it included within a day. But there was more mempool transaction expansion and it took a couple days to clear. So if you want to get a transaction through faster, you’ll need to include the appropriate fee and it will probably cost you a few dollars. Eventually people will tire of the fees to play with the new Ordinal technology and things will return to normal. Some Bitcoin developers want to filter these transactions, but current consensus is to just let the problem resolve itself. Until then the miners are making more money with transaction fees, which sorts out what transactions are important and necessary by what people are willing to pay.

Despite calls for censorship, many developers agree that maintaining the status quo is the right thing to do for now.

The staggering amount of BRC-20 tokens minted via the Ordinals protocol, which clogged the Bitcoin network and sent transaction fees sky-high, has sparked a debate among developers of the blockchain over how to tame the on-chain frenzy.

The debate is playing out on the bitcoin-dev mailing list, which hosts discussions about Bitcoin development. Opinion is divided on whether more drastic steps should be taken to curb the sudden surge in BRC-20 mints.

The soaring fees have forced some bitcoin users in Africa to seek alternative payment options including stablecoins, while crypto exchange Binance said it’s in the process of integrating the “layer 2” scaling solution for Bitcoin known as Lightning Network. It’s been a windfall for Bitcoin miners but has presented an existential conflict for purists of a blockchain designed to be a peer-to-peer payments network but also free from censorship.

“Real bitcoin transactions are being priced out,” wrote mailing list member Ali Sherief, who started the thread on Sunday. “Such justifiably worthless tokens threaten the smooth and normal use of the Bitcoin network as a peer-to-peer digital currency, as it was intended to be used.”

Sherief recommended mitigating Ordinals token mints by drafting and implementing a bitcoin improvement proposal (BIP) or making changes to Bitcoin Core, the primary software for connecting to the Bitcoin network.

Not everyone agrees. Michael Folkson, an organizer for the London Bitcoin Dev meetup group, said Bitcoin should maintain its status quo.

“Consensus rules are set and the rest is left to the market,” Folkson wrote. “You may not like this use case, but assuming you embark on a game of Whac-A-Mole, what’s to stop a group of people popping up in a year declaring their opposition to your use case?”

‘Mass minting’

The Ordinals protocol allows users to inscribe data onto the smallest units in Bitcoin – satoshis or “sats.” The result is a unique non-fungible token (NFT).

On March 8, Twitter user Domo used Ordinals to inscribe snippets of code called JavaScript Object Notation (JSON) data to enable minting of a stupendous amount of fungible tokens, some with total supply in the quadrillions, many of them practically useless.

Sherief was quick to point out that it was Domo himself who labeled his own creation “worthless.”

“These will be worthless. Please do not waste money mass minting,” Domo tweeted in March. CoinDesk reached out to Domo seeking comment on whether he still considers BRC-20s worthless but he is yet to respond.

Over 14,300 tokens have already been minted, some with a total supply of 420 quadrillion. Total market cap for BRC-20 tokens approached $1 billion earlier in the week, and Domo’s test token ORDI – created for no practical use other than to illustrate how BRC-20 minting works – is leading the pack and trading at $7.90 at the time of reporting, with a market cap of $161 million, according to CoinGecko.

That recent flurry of activity is what prompted several developers, including Sherief, to label BRC-20s as spam earlier this week and brainstorm ways to curtail the minting mayhem.

“I think everyone on this list knows what has happened to the Bitcoin mempool during the past 96 hours,” said Sherief. “Due to side projects such as BRC-20 having such a high volume.”

Bitcoin’s mempool, short for memory pool – a database of unconfirmed transactions – has indeed been congested, and at one time had nearly half a million unconfirmed transactions. The number of unconfirmed transactions was well under 50,000 for most of 2022.

‘Spam filtration’

Longtime Bitcoin developer Luke Dashjr created an Ordinals spam patch filter in February called Ordisrespector that detects Ordinals transactions then rejects them. Dashjr chimed in on Sherief’s discussion thread and called for a change in Bitcoin Core that would filter out the controversial transactions, which he also referred to as spam.

“Action should have been taken months ago,” Dashjr wrote on Monday. “Spam filtration has been a standard part of Bitcoin Core since day 1.”

No change will be made to the Bitcoin protocol or to Bitcoin Core for now, so the minting appears set to continue.

“Miners are making millions of dollars from these inscription transactions,” said veteran Bitcoin Core developer, Peter Todd, in response to Dashjr. “Many people like myself will continue to run nodes that do not attempt to block inscriptions.”