I’ve been hearing people on the ham bands ignorantly talking about cryptocurrencies, so I thought I’d offer the case for the one that has real value, Bitcoin. In essence Bitcoin is a cryptocurrency protocol for trustless financial transactions using public/private key cryptography. To use the currency you use a wallet which in essence contains public and private keys and a way to track and issue transactions. A feature of public/private key cryptography is that you can use your secret key to sign data, and people can use your public key to verify the signature and validity of the enclosed data. And your public key can be used to encrypt data to you which can only be decrypted by your private key. So in essence, you use your private key to verify you control funds which people can verify with your public key and this provides the basis for this trustless system based on mathematics. No central authority is needed to maintain the system, nor can a central authority change transactions or manipulate data. With your secret key you prove you control the funds you’re transacting with.

What is the compelling case for Bitcoin is the proof of work mechanism that requires an investment of energy. In simple terms, based on the mining power online there is a difficulty adjustment that changes to ensure that a block of transactions is mined about ever 10 minutes on average. This has to do with finding a nonce when multiplied against the block hash that results in a certain number of leading zeros, and this requires a lot of hashing power. Calculating the new block of transactions is easy, but finding this nonce is time and power intensive by design. The reason miners invest power and equipment for this task is they get a block reward and receive the transactions fees. The block reward is a certain amount of Bitcoin set aside for miners and added to the pool of available Bitcoin with each new transaction block, and this reward halves about every four years until it eventually is removed with the system turning to transaction fees alone as the only block reward when the system is fully established. This power and processing cost provides security to the system so people can’t change transactions and create false blocks of transactions. Consequently, there is a threat of manipulation if anyone can control more than 50% of the mining power, but with mining pools and mining machines dispersed around the globe this is highly unlikely. And miners have significant incentive to not harm the system jeopardizing their hardware investment along with their Bitcoin holdings.

And the global nature of Bitcoin is another security feature as it exists outside any one country or economic block of control. Bitcoin will continue to function even if outlawed in several nations, and Bitcoin is not able to be regulated by any one nation, as the world consensus of Bitcoin is determined by the software everyone runs which no one nation can control. Consequently, nations have moved to strictly regulating on ramps and off ramps with Know Your Customer (KYC) and Anti Money Laundering (AML) rules for tracking and collecting capital gains taxes. Bitcoin works via a public blockchain of all transaction data, so if they can pinpoint ownership of certain transactions they can follow those subsequent transactions though there are ways to protect privacy with further privacy enhancements to be added to the protocol.

Now when people say that Bitcoin has no value, you have to consider that Bitcoin is basically a payment protocol and global payment system with distributed computing power around the globe, and that is what gives it value. Consider that the market cap of VISA and MasterCard combined is over $700 Billion. Moreover, Bitcoin is fixed and deflationary, as there will only ever be a finite amount of Bitcoin and not increased without a consensus of all users who have an incentive to not devalue their holdings by increasing the number of Bitcoin. So contrary to government fiat currency and fractional reserve banking, there is no money printing leading to incredible inflation like we see today. In fact, in it’s decade of existence Bitcoin has already risen an incredible amount being $114,000 at the moment. When I first started using Bitcoin to pay for Tor servers it was valued at $440 and I thought it might rise to $10,000 when we finally had the financial collapse which has been pushed out for years through fed and market manipulation. For so many people and countries, Bitcoin is a much better currency than their fiat government currency, as countries strive for 2% inflation, meaning your currency savings are purposely devalued by 2% each year (actually much higher which everyone can relate to today). And for many countries their currency has been devalued to a much higher degree.

Consequently, this deflationary feature of Bitcoin is a case for it being a good store of value along the lines of gold. If you consider inflation over the decades, gold should be valued at $10,000 or more. However, the paper gold markets are heavily manipulated to keep the price down until the economic collapse ramps up and they lose control. Of course, nations are using the low prices to acquire large amounts of gold as The Great Reset and new financial system will be defined by gold holdings and a new reserve currency possibly backed by gold (the dollar in its heyday was backed by gold). But with looking at a serious financial collapse, even people with fiat currency holdings in stable western nations are looking at having their holdings severely devalued. And most investment professionals will tell you, be diversified usually recommending gold as a hedge investment against financial upheavals. The hedge of gold is based on it being a means of exchange with value, but today Bitcoin is much easier to acquire and exchange verses physical gold making it much more accessible to a lot more people.

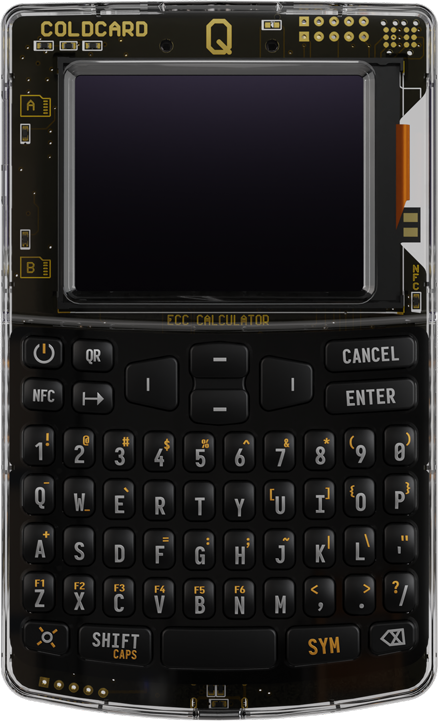

I’ll link to The Bitcoin Standard: The Decentralized Alternative to Central Banking which is a very good book on the value of Bitcoin. And if you ever think about investing in Bitcoin in a substantial way, the saying goes in Bitcoin “not your keys, not your Bitcoin”, so take a hard look at hardware wallets which protects your private key from being accessed by a computer which could be compromised. And make sure you write down and safely store your seed phrase that represents your private key as a backup. Bitcoin is one of the few things that as you learn more about it, the more you appreciate the technology and how far it has advanced in the last decade. And Bitcoin has been out there in the wild to be attacked, and it has only grown stronger.

Worth pointing out, there are conspiracy theories that Bitcoin was released as a way to prepare the way for Central Bank Digital Currencies by getting the masses willing to trust the technology. But with CBDCs we’re in the same boat as fiat currencies with inflation, money creation, manipulation by central authority… and a complete lack of privacy with the ability to cut people off from their money if they are deemed an “enemy” of the state, and even limited in what you can purchase. But even if Bitcoin was a psyop, it’s out and open belonging to the community of users who vote by what software they use and how they value the technology. And the technology is so approachable, you can run your own mining machines or your own node on minimal hardware. In a world dominated by billionaire elite bankers that purposely devalue our hard earned treasure, Bitcoin is a shining jewel to help us take some control of our finances back from the cruel banking system inflicted upon us.