First off, Roger Ver is a controversial figure who was part of a scheme that tried to hijack Bitcoin back in 2017 leading to a hard fork creating Bitcoin Cash. But my interest in this story is the US Exit Tax, which is basically a wealth tax making you pay taxes as if you sold all of your assets before leaving the country and renouncing your citizenship. You generally pay capital gains taxes on assets when sold based on how they increased during the time you held them if over a certain value based on income, so it’s a wonderful example that our greedy government wants to take your money which you risked in investing in the first place. A lot of people on the left have been clamoring for a wealth tax, and this is a good example of one. And California was trying to implement something similar for people who leave California. Consequently, before 1913 we didn’t even have capital gains or income tax in this country.

What is the exit tax?

Under Sec. 877A, a U.S. exit tax may apply to individuals who relinquish their U.S. citizenship or are long-term residents who cease to be a U.S. permanent resident. The tax is designed to make sure that all unpaid taxes are settled before a U.S. citizen or resident withdraws from the U.S. tax system. Individuals subject to the exit tax generally are assessed tax as if they had sold all of their assets the day before they left the country, also known as a “deemed distribution.”

https://www.zerohedge.com/crypto/roger-ver-moves-dismiss-us-tax-evasion-charges-unconstitutional

By Tom Mitchelhill via CoinTelegraph.com

Roger Ver — also known as Bitcoin Jesus — urged a United States judge to dismiss a case alleging he committed tax evasion when selling millions of dollars in Bitcoin, claiming the case is unconstitutional.

In a Dec. 3 filing to a California federal court, Ver argued that the Internal Revenue Service’s (IRS) exit tax for those who renounce their US citizenship with more than $2 million in assets is unconstitutional and “inscrutably vague.”

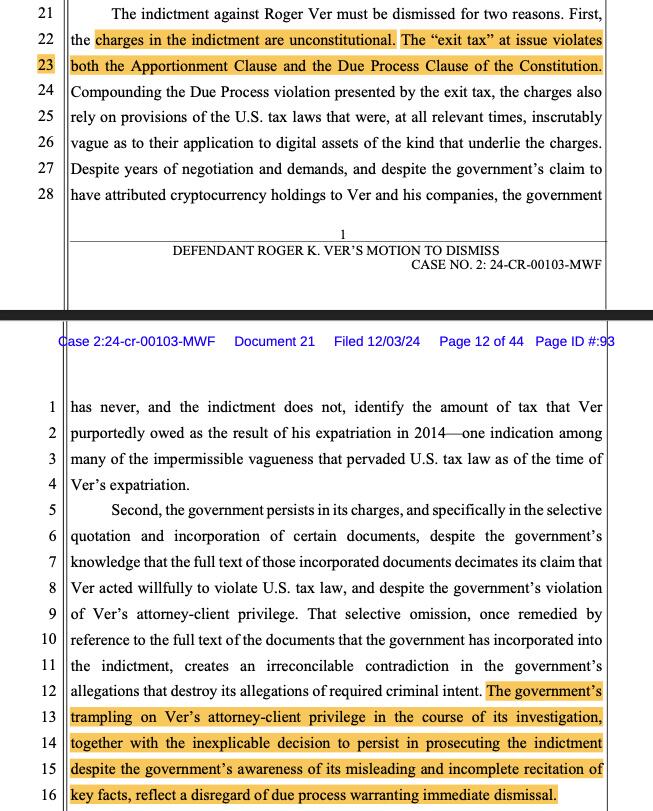

“The ‘exit tax’ at issue violates both the Apportionment Clause and the Due Process Clause of the Constitution […] the charges also rely on provisions of the U.S. tax laws that were, at all relevant times, inscrutably vague as to their application to digital assets of the kind that underlie the charges,” Ver’s lawyers argued.

The IRS’ exit tax aims to ensure that US citizens pay all required taxes before renouncing their citizenship and withdrawing from the country’s tax system.

Lawyers for Ver claim that the case against him is unconstitutional. Source: CourtListener

Ver also claimed prosecutors had “unlawfully” interrogated one of his lawyers and ignored crucial documents, which he said showed he had no intent to file a fraudulent tax return.

On April 30, the US Attorney’s Office in Los Angeles arrested Ver in Spain and charged him with tax evasion and fraud, alleging he dodged more than $48 million in taxes by failing to report capital gains on the sale of “tens of thousands” of Bitcoin for $240 million in cash.

Ver claimed there were several impediments to submitting an appropriate exit tax request, including a lack of liquid markets for Bitcoin at the time. Still, the US government remained adamant that Ver filed a fraudulent and false exit tax after renouncing his US citizenship for a Japanese one in 2014.

Ver has been charged with mail fraud, tax evasion and filing false tax returns. He faces a maximum sentence of 30 years in federal prison if found guilty on all counts.

Ver was one of the earliest advocates of Bitcoin, buying it in droves in 2011 when it was under $1 and acting as an evangelist for digital assets. In 2017, he emerged as a major Bitcoin Cash (BCH) proponent after the Bitcoin network underwent a hard fork.

Ver was later embroiled in a 2022 scandal with CoinFlex, which claimed that he owed the platform $47 million in USD Coin.

In 2002 and 2003, he spent 10 months in federal prison in the US for selling explosives on eBay.

The US Department of Justice did not immediately respond to a request for comment.