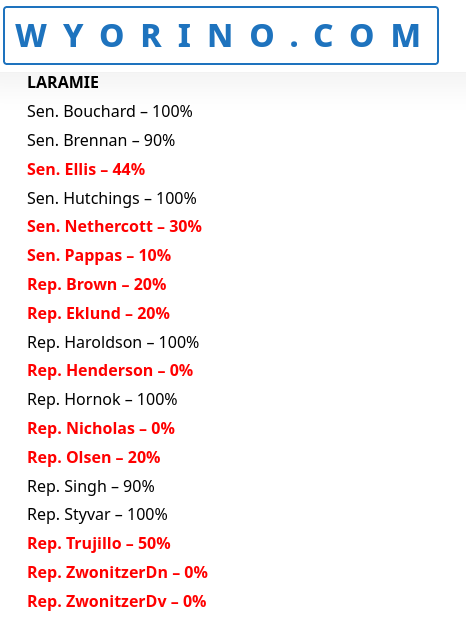

I’ve met Sen. Anthony Bouchard, a fellow conservative California transplant, who has done a good job for Wyoming. And below you can see that he has a solid score on wyorino.com (to be a Republican you’re not supposed to vary from the Rebpublican platform by more than 20% – doing so gets you labeled a RINO, undercover Demonrat really). And all the states are negligent in fixing property taxes that have been significantly hiked by bad economic policies nationally along with holding up home development locally (agenda 2030), which is all part of an OCGFC scam to impoverish the debt slaves by extracting ever greater amounts of wealth from them. So the article is a look into an amendment up for vote next week, and I love the fearmongering around other tax increases if it passes, as they did fine before elevated home prices and property taxes.

Legislators are fighting over a constitutional amendment that could lower property taxes for homeowners in Wyoming. Some argue Amendment A on next week’s ballot also opens the door for tax increases, if passed.

By Leo Wolfson

Wyoming voters will decide what’s become a controversial constitutional amendment in the election next week, a reform of the state’s property tax structure that’s been more than a year in the making.

Senate Joint Resolution 3 passed into law without much opposition or controversy in 2023, which put the constitutional amendment on the Nov. 5 election ballot that, if passed, would create a separate fourth class of taxation for residential properties in Wyoming. Amendment A would create a subclass of primary residences that could be assessed and taxed at a different rate than other properties in the state.

The amendment has been advertised as an avenue for property tax relief, but many of its opponents have raised concerns that the tax rate could also be raised at some point in the future.

The Wyoming Constitution requires property to be assessed at full value, uniformly, but the amendment would allow for residential properties to be taxed as low as 7.5%. Now, commercial property, real and residential properties are all taxed at 9.5%, while industrial is assessed at 11.5%.

Any of these changes would happen as a result of future legislative action if the amendment passes.

Surprising Supporter

State Sen. Anthony Bouchard, R-Cheyenne, supports the amendment and believes that those opposing it are doing so to create chaos rather than bringing effective solutions.

Bouchard has specifically called out Sens. Cheri Steinmetz, R-Lingle, and Larry Hicks, R-Baggs, and Rep. John Bear, R-Gillette, on Facebook for their opposition to the amendment.

In response, some people have called Bouchard a “tax and spender,” although Bouchard has been one of the most conservative legislators in the state during his seven years in office.

Although Steinmetz and Hicks didn’t, Bear voted to support the final version of the amendment in 2023, which Bouchard said is proof that Bear was “literally clueless” about what he was voting for.

“When you see guys like John Bear, who voted for this amendment and now he’s against it … that’s chaos,” Bouchard said. “What? He wasn’t smart enough then and now he is?”

Bear told Cowboy State Daily he wasn’t a big fan of the constitutional amendment at the time, but voted for it at the very end of the 2023 legislative session because nearly all of the more than 20 other property tax relief bills proposed that session had already died.

He had attempted to include tax caps within the constitutional amendment but those were voted down.

“It was our last chance in 2023 for the people of Wyoming to get some tax relief,” Bear said.

He also said Bouchard’s position on the amendment is telling.

“Anytime Anthony Bouchard is in the same category as the Democratic Party of Wyoming, you know that he’s probably wearing the wrong pants,” Bear said.

Bouchard wants the Legislature to be able to permanently tax seniors and low-income veterans at a lower rate than other homeowners.

“If we can’t adjust that primary residential property differently, if we’re going to stick to everybody has to be treated the same and we’re just going to screw everybody, we’re not doing our job,” he said. “How do we protect those owners if we don’t separate that field?”

He also believes it’s incredulous to suspect that lawmakers may raise the property tax rate someday when considering Wyoming’s political makeup.

“Who wants that on their political tombstone?” he questioned.

As a result of the August primary election, the Wyoming House moved noticeably to the right politically with the Wyoming Freedom Caucus picking up more than 10 seats.

Bear agrees that concerns about property taxes being raised is a “false flag,” but believes the larger problem at play is overall government spending.

He said he won’t feel confident about property tax rates being reduced until government spending goes flat or reduces in Wyoming, which could theoretically create a surplus of tax revenue that could lead to cuts down the road.

Constitutionality

Former state legislator Jayne Mockler, now a member of the Wyoming Board of Equalization, doesn’t believe property tax exemption bills such as a 4% cap put on year-to-year property tax increases for residential properties passed during the most recent legislative session are constitutional.

Mockler said this bill results in assessing residential properties at different rates across Wyoming based on the tax breaks they are handing out.

The Wyoming Constitution states that all residential properties be assessed uniformly and only provides for a very limited range of exemptions. It also forbids the creation of new classes and subclasses.

The 4% bill comes with the caveat that the cap will reset whenever a new owner takes over a property or if its square footage is adjusted.

Mockler argues that people who live in an area that saw a tax increase of less than 4% will be assessed disproportionately when compared to those whose taxes exceeded a 4% increase, a situation that would be likely to develop between the homeowners of the highly affluent Jackson and more modest Lusk, or even among neighbors when one is a new homeowner.

“There are long-term repercussions to messing with the value and the uniformity of our tax system,” she said. “I don’t think the house cares who lives in it.”

That the cap is limited to primary homeowners is something Mockler also finds discriminatory.

She believes property tax increases are always driven by what the market will bear.

Bear sees property taxes as a tough nut to crack and finds it to be debatable whether the new law is constitutional.

Bear said although he opposes Amendment A, he doesn’t vehemently so and finds that although “it’s not the worst thing, it’s just not that helpful.”

“It’s just a simple tool to make voters feel like they’re getting a tax break,” he said.

Bear worries that it could lead to an increase in taxes on commercial and agricultural properties to make up for the lost tax revenue from residential homeowners.

In return, Bear sees those taxes eventually getting passed over to the consumer with price increases. In 1988, commercial property was lumped in at the same taxation rate as residential in Wyoming to protect industry from future increases.

If the amendment doesn’t pass, Bear said the Legislature will continue to pass tax exemption bills until they are challenged in court, which he acknowledges could happen.

“If it does not pass, we’re going to continue using the exemption methodology until the courts say we can’t,” he said.

This June, Mockler voted against certifying the 2024 assessment values for Wyoming’s counties because of her constitutional concerns. She expects a lawsuit to be filed at some point as a result of some of the exemption bills.

Many like Bouchard argue that the constitutional amendment needs to pass to make some of the tax exemption bills that were passed this year constitutional. Mockler and Bear disagree.

“I think everybody thinks it’s a panacea and it’s not,” Mockler said.

What Other States Are Doing?

A similar proposal was passed in Texas in 2023, orchestrating an $18 billion tax cut for homeowners and businesses.

But some in Texas have said this resulted in taxes increasing as certain appraisal districts increased their property values as a way some believed “to counteract the ‘relief,’” according to Newsweek.

In Nebraska, a similar proposal to the one being considered in Wyoming was gaining traction in its Legislature in August but has since stalled out.

California established property taxation based on acquisition value of a home in 1978 and has never looked back. However, many people have argued this resulted in a sizable increase in other taxes levied there since that time.

This fall, voters in North Dakota will consider a proposal to largely end property taxes in their state. Similar fears are being raised there however that lawmakers will simply raise taxes somewhere else.

“Those fear tactics will come back and bite them,” Bouchard said. “They just don’t see beyond their nose on this fight. If it’s this hard to get a fractional change (in Wyoming), then think how hard it would be to get what North Dakota is doing.”