I’d avoid any business that won’t accept cash. For most of our purchases except larger box stores, we still use cash, but then I’m old school and don’t like using my cards at too many places as their security and vendor solutions can be questionable. Though you are protected by the smart chip and new credit card numbers being generated (and I can generate virtual cards for online purchases). What’s funny, is that they charge so much in fees for credit card purchases that you’d think merchants would reward cash users like a local restaurant does, not to mention credit cards compete in the market by giving you part of that fee back on purchases which is ridiculous unless you see it as purposeful in incentivizing you to go cashless. Consequently, It’s really about that last little bit of financial privacy being removed.

by Tyler Durden

Fans heading to Yankee Stadium hoping to pay in cash at the iconic ballpark for their favorite concessions have been thrown a curveball: go cashless or pay extra.

As the Wall Street Journal reports, Noa Khamallah, a 41-year-old New Yorker, found out the hard way. Looking to enjoy some popcorn and soda at a game, Khamallah was shocked to discover that his cash was as good as obsolete. Instead, he was directed to a “reverse ATM,” where he inserted $200 only to receive a debit card with $196.50 – after he was hit with a $3.50 service fee for the ‘convenience’ of going cash-free.

“It’s just not right,” Khamallah told the outlet, echoing the sentiments of other New Yorkers shocked that what used to save you money – cash payments, now costs more. In some cases, transaction fees have soared more than $6 just for the privilege of spending your own funds.

Indeed, cashless venues and restaurants are popping up across the country, forcing cash lovers to either adapt or pay up as the war on cash continues.

Reverse ATMs like those at Yankee Stadium are now common at cashless venues and restaurants across the country as a way to cater to those who prefer paying in cash. People who want to pay their parking tickets, tolls, taxes or phone bills in cash, meanwhile, often learn that government agencies and businesses have outsourced that option to companies that usually charge a fee.

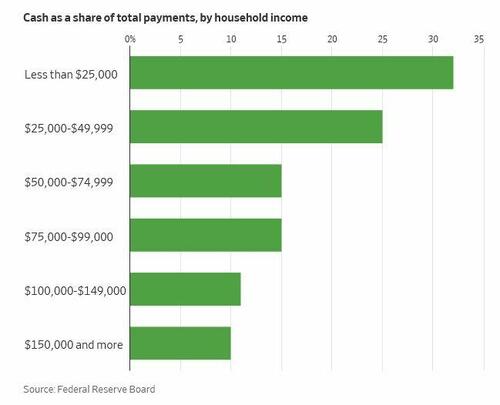

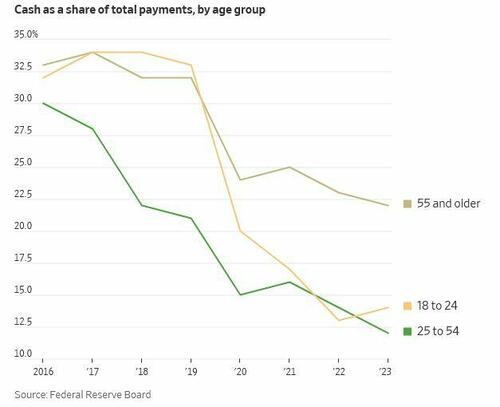

All that can amount to a penalty on the people who prefer paying cash. Though it is more common to buy things with cards and mobile devices, cash remains the third-most popular way to pay, accounting for 16% of all payments in 2023, according to the Federal Reserve. That’s down 2 percentage points from the year before, continuing a steady decline that accelerated during the pandemic. -WSJ

And it’s not just about convenience or the speed of transactions. Critics argue that the move sidelines those who rely on cash – often the young, the elderly, or the poor.

“To let my 13-year-old go buy a slushy at the amusement park, I’m already out $6,” said Prudence Weaver, 41, who said she would rather be able to use cash on trips to the zoo and other venues vs. paying fees for debit cards. “I understand that there is a place for electronic payment, but I don’t think it should be the only option.”

Despite the digital dominance, cash is still king for a significant chunk of Americans. According to the Federal Reserve, a full 16% of all payments in 2023 were made in cash, down 2% from 2022.

“It’s unbelievable that we actually have to tell retailers, ‘This is U.S. currency and it’s something that should be accepted,’” said Jonathan Alexander, executive director of the Consumer Choice in Payment Coalition, a group of businesses and nonprofits lobbying for the continued acceptance of cash.

The backlash has spurred some action. States like Colorado and Rhode Island have pushed back, banning cashless retail establishments. On Capitol Hill, lawmakers are batting around bills that would make it mandatory for businesses to accept cash for purchases under $500.

But the future of these efforts remains uncertain. In the meantime, companies like RedyRef are cashing in, literally, doubling their shipments of reverse ATMs to keep up with demand from businesses ditching traditional cash transactions.

“It has been a pretty wild shift,” said Will Pymm, senior vice president. “Probably one of the biggest we’ve seen for a specific product, in such a short amount of time.”

Even as venues pocket fees from these new systems, the debate rages on whether this shift truly serves the public or merely lines the pockets of corporate giants. At stadiums, amusement parks, and beyond, the cost of going cashless continues to climb – and it’s everyday consumers who are footing the bill.

So next time you head out to a ball game, remember: bring your plastic, or be prepared to pay up.