I’m surprised Charbucks is lasting this long, as they have a terrible product with severely overroasted coffee beans (headline story below). Consequently, I’ve posted about how I buy green arabica coffee beans and roast them myself at home, and for good quality green coffee beans the prices have been going up on my last two orders (I order 15 lbs at a time). Of course this is for quality green arabica coffee beans from Ethiopia which is my favorite coffee origin, and you can include the rest of NE Africa for having great coffee too. So even though Starbucks is keeping prices just below $5 for their main hot drinks, they’re going to have pressure to raise prices or squeeze margins. Interestingly, their profit in North America is 18%, so could they forgo profit to keep the price down? So out of that $4.65 Caffe Mocha, they’re making $0.84 in profit, indicating their overhead and having so many locations is really costing them a lot of money. And they also claimed to spend more on health care for workers than they do on coffee which should get the CEO fired. And their siren logo with legs/tails held apart in a sexual way is pretty creepy, and originally included exposed breasts, which tells you something about the founders and corporate management. Anyway, there is no compelling reason to own this stock or drink any of their inferior products.

https://www.zerohedge.com/markets/starbucks-brink-worst-crash-dot-com-after-stunning-earnings-miss

By Tyler Durden

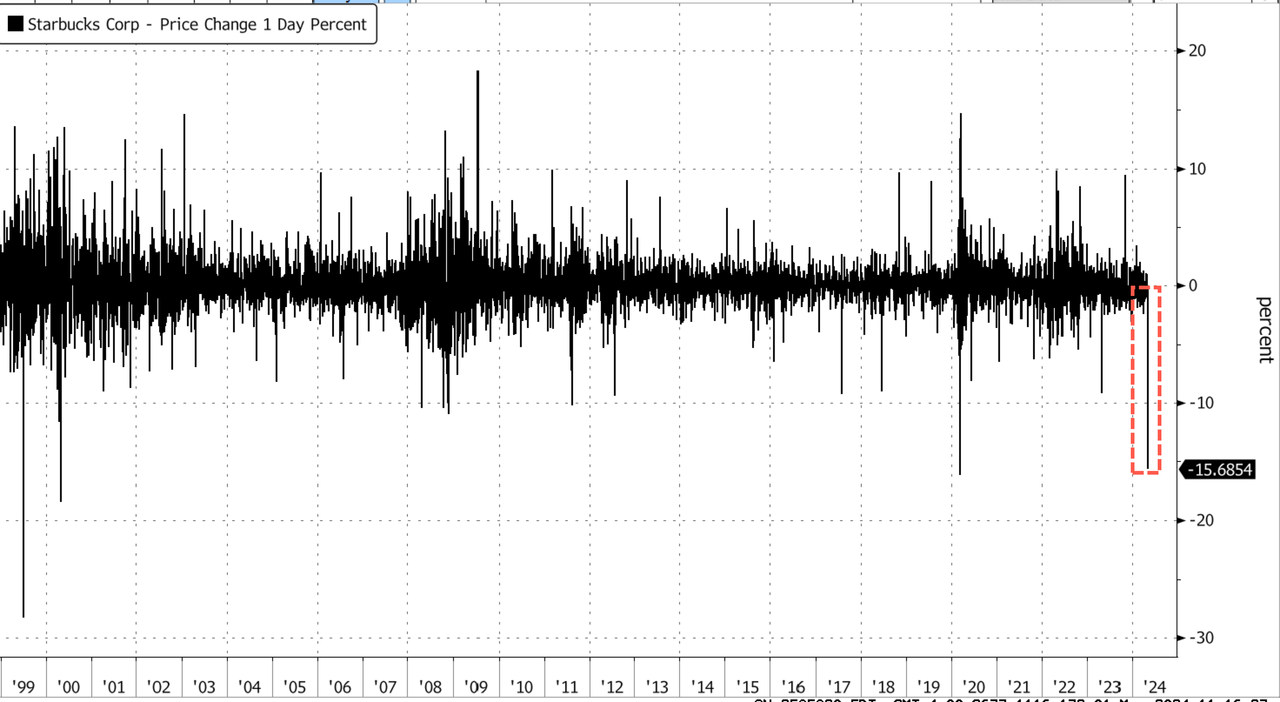

Starbucks shares plummeted by 16% during the early cash session, approaching the -16.2% level last seen during the Covid crash. If intraday losses surpass 16.2% and remain above this level at closing, it would mark the company’s worst single-day loss since the Dot Com crash in early 2000.

“Starbucks reported what’s perhaps the worst set of results of any large company so far” this quarter, analyst Adam Crisafulli of Vital Knowledge wrote in a note. William Blair downgraded the coffee chain, citing last quarter’s “stunning across-the-board miss on all key metrics.”

Starbucks reported a 4% drop in same-store sales in the second quarter compared with the same period last year, while analysts tracked by Bloomberg were expecting growth. In China, same-store sales plunged 11%. The company’s top geographic segments are showing a pullback in consumer spending.

On Tuesday evening, CEO Laxman Narasimhan started the earnings call with investors by clarifying his unhappiness with last quarter’s results.

“Let me be clear from the beginning. Our performance this quarter was disappointing and did not meet our expectations,” Narasimhan said.

He said major headwinds originate from a “cautious consumer,” adding, “A deteriorating economic outlook has weighed on customer traffic and impact felt broadly across the industry.”

Here’s a snapshot of the second quarter’s earnings results (list courtesy of Bloomberg):

- Comparable sales -4%, estimate +1.46% (Bloomberg Consensus)

- North America comparable sales -3%, estimate +2.05%

- US comparable sales -3%, estimate +2.31%

- International comparable sales -6%, estimate +1.36%

- China comparable sales -11%, estimate -1.62%

- Adjusted EPS 68c, estimate 80c

- Net revenue $8.56 billion, estimate $9.13 billion

- Operating income $1.10 billion, -17% y/y, estimate $1.35 billion

- Adjusted operating margin 12.8%, estimate 14.5%

- Operating margin 12.8%, estimate 14.4%

- North America operating margin +18%, estimate +19.5%

- International operating margin 13.3%, estimate 15.2%

- Channel development operating margin 51.7%, estimate 43.6%

- Average ticket +2%, estimate +2.41%

- North American average ticket price +4%, estimate +4.15%

- International avg. ticket -3%, estimate +0.1%

- North America net new stores 134, estimate 144.33

- International net new store openings 230, estimate 429.23

- Comparable transactions -6%, estimate -0.27%

- North America comparable transactions -7%, estimate -1.86%

- International comparable transactions -3%, estimate +1.37%

Goldman analysts Eric Mihelc and Scott Feiler told clients, “Expectations were for a clear sales miss and a modest EPS miss, but both came worse than the lowered bar.”

They added, “The miss was across geography and was as bad, if not worse, than worst fears.”

Other Wall Street analysts shared the same gloom and doom about the coffee chain (list courtesy of Bloomberg):

Deutsche Bank analyst Lauren Silberman cuts Starbucks to hold from buy

- Says the “challenging” results was a sign “headwinds are more pervasive and persistent than we expected, and we have limited visibility into the pace and magnitude of a recovery”

- Had thought comparable sales deceleration in the US was more transitory and isolated to a specific cohort

- However, with the decline in 2Q traffic and what seems to be limited improvement from Lavender and Spicy Refreshers, Silberman sees it being difficult to “underwrite a meaningful reacceleration,” which is key to the bull case

William Blair, Sharon Zackfia (cuts to market perform from outperform)

- After healthy demand over the past three years, Zackfia says the “tide has turned quickly,” with Starbucks posting the weakest traffic performance outside the pandemic or Great Recession

- China now “looks more fragile,” with comparable sales down 11%, and even Starbucks Rewards members “took a rare dip,” she adds

Jefferies, Andy Barish (hold)

- There was a “notable” miss on US and international comparable sales as well as EPS, and Barish says there is “no easy fix in sight to reaccelerate SSS near-term”

- Notes that international comparable sales was “similarly weak,” with traffic and comparable transactions both declining; China’s comparable sales miss and Middle East volatility more than offset positive comps seen in Japan, APAC and Latin America

- PT cut to $84 from $94

Citi, Jon Tower (neutral)

- Starbucks is “putting a lot of oars in the water to try and paddle” its way back to a stable comparable sales outlook that investors would be willing to underwrite

- However, Tower expresses concern that there is not enough “coxswain keeping oarsmen working in unison/with accountability”; adds that it ignores the “true leak in the bottom of the boat,” flagging broad consumer pushback to cumulative transaction growth and the value equation

- Notes China store margins are still in the double digits and the segment is profitable despite top-line declines

- PT cut to $85 from $95

Cowen, Andrew Charles (hold)

- “We believe 2024 guidance has been derisked as we model 0% NA comps & 3% EPS growth, the high end of the range”

- Expects shares to be in a “holding pattern” as Starbucks restores credibility while competition and tough macroeconomic conditions present headwinds

- PT cut to $85 from $100

Bloomberg Intelligence, Michael Halen and Jennifer Bartashus

- “Starbucks slashed fiscal 2024 same-store sales, revenue and EPS guidance and lacks a cogent plan to boost demand”

- “We believe several initiatives, including targeting overnight sales, dozens of new products and a four-week mobile- app upgrade cycle are overkill — a distraction unlikely to boost traffic”

On Tuesday, a similar story occurred at McDonald’s when the burger chain reported lower-than-expected quarterly sales growth.

Notably, working-poor consumers are pulling back spending in a period of stagflation (read here & here).