I was surprised by how high these are, and we’re not really into the depression quite yet. And with most cards having extremely high interest rates, once you fall behind you’re unlikely to get caught up unless you utilize a credit counseling service that will close your account and negotiate repayment terms to avoid a charge off and lower interest rates. This is why I have one credit card that is paid off monthly for which I never pay any interest, and used mainly for online purchases which also has the capability of creating virtual credit card numbers per vendor for security of the main card. Consequently, I cancelled PayPal a while ago when it came to light they had rules for taking funds from your bank account which they force you to link to your account, and were thinking of expanding these rules to include terms for “disinformation”. And PayPal has gotten ridiculous with their fees where at least credit card companies kick back a portion to the customer, though not ideal for businesses. So best to not fall for the trap of having something now you can’t afford to pay for and letting interest payments consume your precious income, and with so many impending charge offs coming they’re probably going to have to extract that money from their paying customers through higher interest rates.

https://www.zerohedge.com/personal-finance/mapping-credit-card-delinquency-rates-us-state

by Tyler Durden

Credit card debt carries a hefty bill in America, and falling behind on payments can be extremely costly for cardholders.

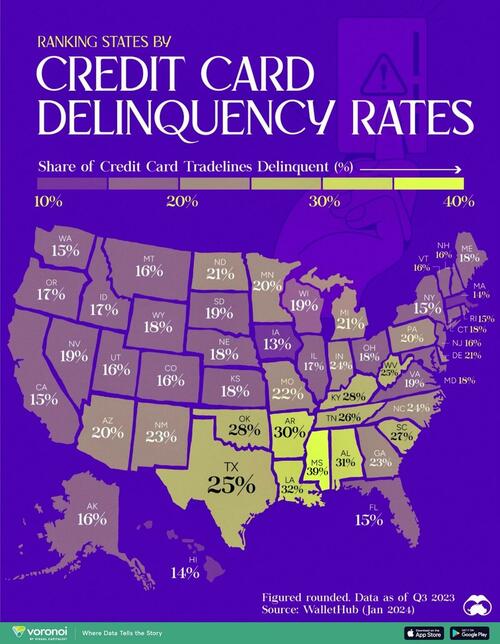

This graphic, via Visual Capitalist’s Marcus Lu, shows credit card delinquency rates across 50 U.S. states, as of Q3 2023. This data comes from a WalletHub study published in January 2024.

Which States Have the Lowest and Highest Delinquency Rates?

Credit card delinquency is when a cardholder falls behind on required monthly payments. Credit agencies are often notified after two months of delinquent payments.

WalletHub examined proprietary user data on the average number of delinquent credit card tradelines—also known as credit accounts—across states. Here they are from lowest to highest:

| Rank | State | Share of Credit Card Tradelines Delinquent (%) |

|---|---|---|

| 1 | Iowa | 12.9 |

| 2 | Massachusetts | 13.9 |

| 3 | Hawaii | 13.9 |

| 4 | Rhode Island | 14.7 |

| 5 | Washington | 14.7 |

| 6 | Florida | 14.8 |

| 7 | New York | 14.9 |

| 8 | California | 15.1 |

| 9 | New Hampshire | 15.5 |

| 10 | Alaska | 15.6 |

| 11 | New Jersey | 15.6 |

| 12 | Colorado | 15.7 |

| 13 | Utah | 15.8 |

| 14 | Vermont | 16.1 |

| 15 | Montana | 16.1 |

| 16 | Illinois | 16.5 |

| 17 | Oregon | 16.6 |

| 18 | Idaho | 17.0 |

| 19 | Ohio | 17.5 |

| 20 | Connecticut | 17.8 |

| 21 | Maine | 18.0 |

| 22 | Nebraska | 18.1 |

| 23 | Wyoming | 18.1 |

| 24 | Maryland | 18.4 |

| 25 | Kansas | 18.4 |

| 26 | Wisconsin | 18.5 |

| 27 | Virginia | 18.7 |

| 28 | Nevada | 19.1 |

| 29 | South Dakota | 19.3 |

| 30 | Arizona | 19.8 |

| 31 | Minnesota | 19.8 |

| 32 | Pennsylvania | 20.2 |

| 33 | Michigan | 20.9 |

| 34 | North Dakota | 21.3 |

| 35 | Delaware | 21.4 |

| 36 | Missouri | 22.4 |

| 37 | New Mexico | 22.6 |

| 38 | Georgia | 23.1 |

| 39 | North Carolina | 24.0 |

| 40 | Indiana | 24.3 |

| 41 | Texas | 24.7 |

| 42 | West Virginia | 25.2 |

| 43 | Tennessee | 26.2 |

| 44 | South Carolina | 26.9 |

| 45 | Kentucky | 27.6 |

| 46 | Oklahoma | 28.2 |

| 47 | Arkansas | 30.1 |

| 48 | Alabama | 30.5 |

| 49 | Louisiana | 31.7 |

| 50 | Mississippi | 39.1 |

No state had credit delinquency rates of less than 10%, with Iowa coming the closest at 12.9%.

That puts Iowa ahead of wealthier states like Massachusetts (13.9%), Washington (14.7%), and New Hampshire (15.5%).

At the bottom end was Mississippi, which had 39% credit delinquency rates to end 2023. That’s well ahead of the next-lowest states Louisiana (31.7%) and Alabama (30.5%).

It’s notable that the American South had higher rates of delinquency almost across the board. The five states with the highest rates of credit card delinquency are all located in the southeastern region of the country, and Texas had a higher delinquency rate (25%) than other majorly populated states like Florida (14.8%) and New York (14.9%).