The average credit card rate is 22.75%. Let that sink in, and I remember when the congress critters did their credit card reform on late fees and overage fees giving these loan sharks the excuse to raise their interest rates. So yeah, that was a big win for consumers. Consequently, its is a huge wealth transfer scheme preying on people that can’t be disciplined, wanting everything they desire now instead of saving for it. And pagan Christmas (Jesus was born in the fall and not at the pagan winter solstice or Saturnalia) led the pagan world to rack up another $24.75 billion in debt. Of course, the dollar crash is coming and what credit card debt is paid back will most likely be pennies on the dollar. But this does allow the megacorps selling products to move much more inventory than would otherwise be possible raking in profits for now. Except for the auto industry, where poor credit consumers can no longer afford to buy these incredibly overpriced vehicles with higher interest rates and crashing quality (even the former quality manufacturers are cheapening their products and damaging longevity with silicon sealant instead of gaskets…). The reckoning is coming, and consumers are going to find that it’s much harder to file bankruptcy and get out from under their debt leading to the Great Taking.

Consumer Credit Shocker: November Debt Soars After Second Biggest Surge In Credit Card Debt On Record

by Tyler Durden

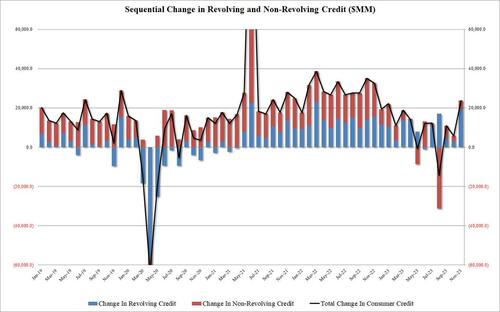

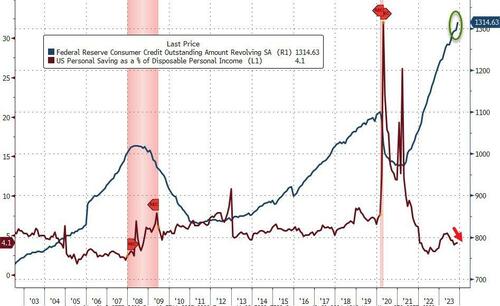

We, and many others, were wondering how it was possible that US consumers – already tapped out beyond a breaking point, with collapsing savings and declining real wages – were able to push holiday spending which started in November and continued until the end of the year – to record nominal highs. Now we know: according to the latest monthly consumer credit report from the Fed, in November, consumer credit exploded higher by $24.75BN, blowing away expectations of a “modest” $9BN increase after the surprisingly subdued $5.8BN (upward revised from $.5.1BN) in October and the $4.3BN average of the past 6 months. This was the biggest monthly increase since last November, and was the first $20BN+ print since Jan 2023.

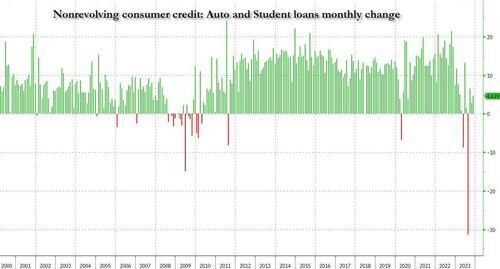

When looking into the details we find something remarkable: while non-revolving credit rose a modest $4.6BN…

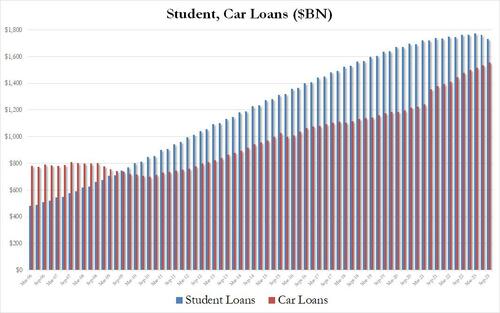

… in keeping with the subdued increase in recent months as rates on auto loans make them prohibitive for most consumers while student loans are actually shrinking for the 2nd quarter in a row…

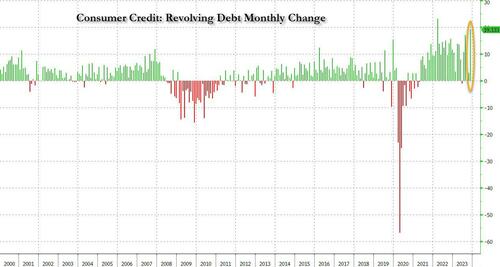

… what was the big shock in today’s data was the blowout surge in revolving credit, which in November exploded by a whopping $19.133BN, a record surge from the $2.9BN in October, and the second biggest monthly increase in credit card debt on record!

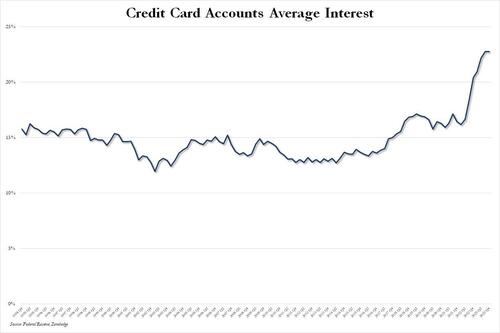

This, despite the average interest rate on credit card accounts in Q4 flat at a record high 22.75% for the second quarter in a row.

What is especially surprising about this conirmation that the bulk of holiday spending was on credit is that it takes place after several months of relative return to normaly, when consumers appeared increasingly reluctant to max out their credit cards due to record high rates, and at a time when the personal savings rate in the US has collapsed back near multi-decade lows in recent months.

Well, it now appears that Americans have once again done what they do so well: follow in the footsteps of their government and throw all caution to the wind, charging everything they can (and whatever they can’t put on installment plans which also hit a record late last year) including groceries, on their credit card, and praying for the best… or not even bothering to worry about what comes next.