A taste of what is coming with CBDCs and social credit scores, as an example of when you go against the owners and controllers of global financialized capital you will be debanked and eventually cut off from your funds and property (see civil asset forfeiture). Consequently, Mercola has some quality products and a lot of good information and truth as I quote many of his articles. And see my post yesterday which explains why they’ve created high inflation and demolishing the petrodollar to drive the world to the Central Bank Digital Currencies, and how you need to find a healthy local bank or start your own if you have the capital. Once people convert to CBDCs, algorithms will decide if they can access their funds and what they can be used for, and just look what Canada did to the Freedom Convoy protestors to see how they will violate the law and crack down on resistance. The walls of the digital Panopticon are being laid all around us and once fully erected you’ll be trapped if you didn’t make preparations.

https://reclaimthenet.org/chase-bank-shuts-mercola-accounts

By Cindy Harper

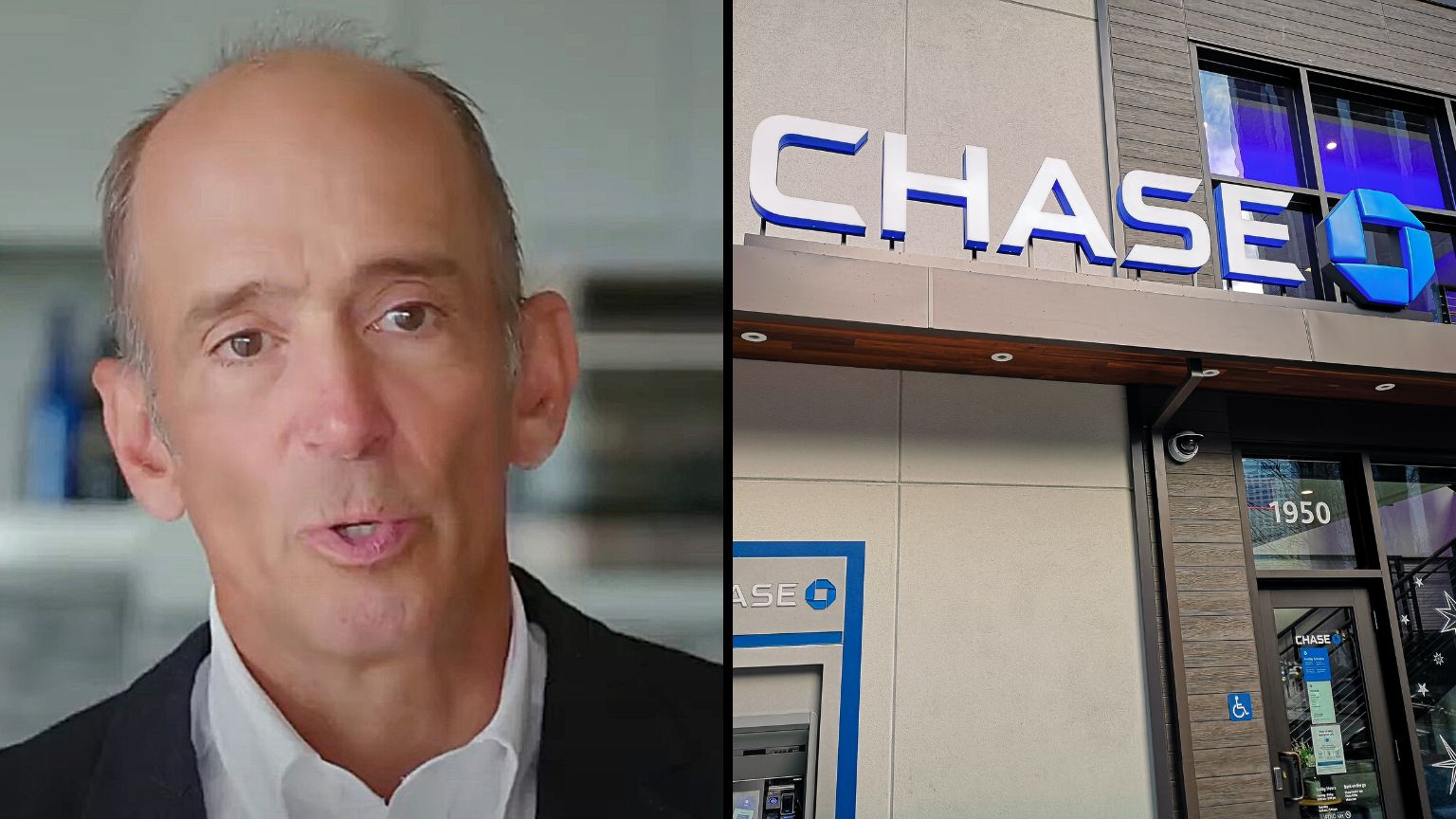

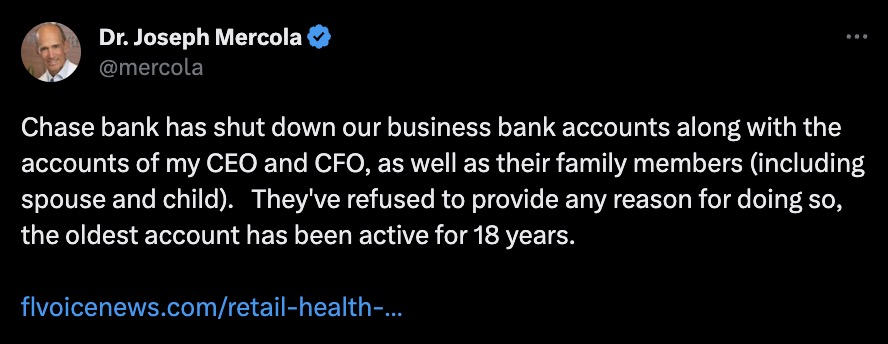

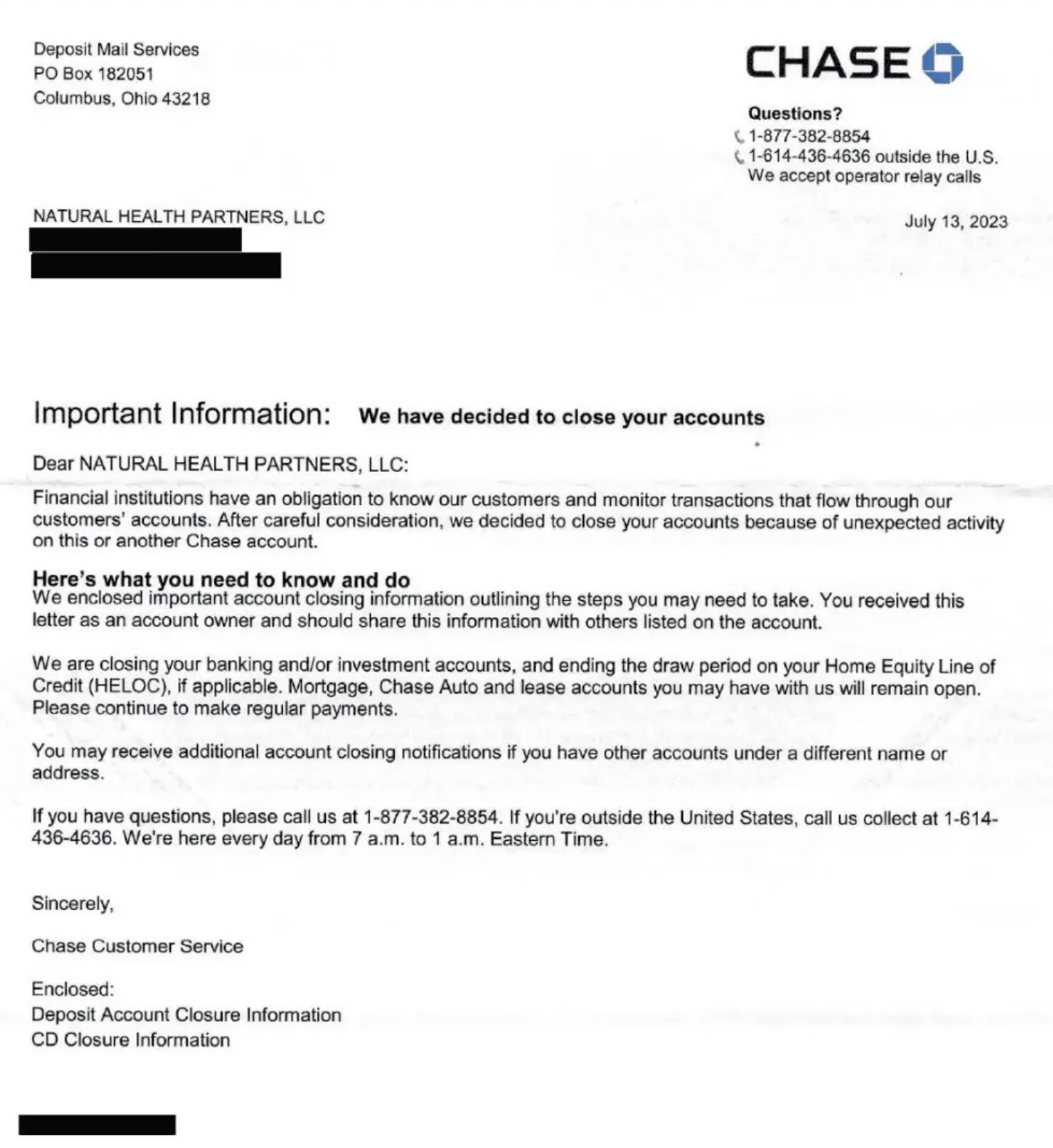

In a recent wave of unexpected closures, JP Morgan Chase has terminated a number of bank accounts associated with Florida-based health retailer, Mercola Market, along with the personal accounts of its employees and their families. The firm’s owner, Dr. Joseph Mercola, is known for his criticism of COVID-19 vaccines and promotion of natural health.

The exact reasons behind these abrupt terminations remain undisclosed. However, numerous employees speculate that these moves may be politically-driven, triggered by Dr. Mercola’s overtly dissenting stance on the public health narrative around COVID-19.

Amid hardships brought about by the abrupt closure, one employee, CFO Amalia Legaspi, has been left scrambling to find means to send funds to her bedridden husband in the Philippines suffering from dementia, while accommodating college expenses for her son, Florida Voice reported.

Initial responses from the multinational bank to inquiries were cryptic, mentioning that the reasons behind the terminations cannot be revealed due to “legal reasons.” Yet, suggestions for submitting paperwork for reconsideration popped up in a voicemail from a Chase representative, leaving account holders in a state of confusion and bewilderment.

Despite the growing outcry from disgruntled account holders, Chase continues its silence. This fiasco brings troublesome indications of potential prejudice based on personal beliefs, as suggested by Mercola Market’s CEO Steven Rye. He added that Chase’s decision to bar his children from holding bank accounts in the future was particularly hard to digest.

Rye’s concerns add fuel to an emerging debate about the potential role of banking providers as arbiters of public discourse, a problem that will get all the more worse if CBDCs are allowed to proliferate.