They do not want you to have any financial privacy, as they’re looking to turn users into KYC reporters and put scores of compliance on UTXOs with user input data through database sites, even mentioning recording scores in the blockchain with the UTXO, as well as locking down on-ramps and off-ramps further. Consequently, this tells the tale that their transaction tracking is terrible as I pointed out in another post. Basically, they want to blacklist coins that at one time maybe were involved with criminal activity or a tainted wallet even though they might have changed hands and been transferred multiple times, and they really can’t track who handled them in between. Their whole transaction tracking is a farce and we need a court to really examine their expert witness claims as I think they’re lying, and it needs to be discredited. And if you always use clean new addresses, it’s near impossible for them to really track you, and why they mention wanting to restrict single use addresses along with outlawing privacy cryptocurrencies like Monero. So they’re using Know Your Customer and Anti-Money Laundering as an excuse to spy on your every financial transaction, just like they did with the traditional finance system.

https://www.therage.co/bank-of-international-settlements-kyc-non-custodial-wallets/

The economists argue that the exclusion of any coin that has ever passed through a no-KYC wallet would enable a culture of self-policing.

Economists at the Bank of International Settlements (BIS), often referred to as the central bank of central banks, have published a paper for a new approach to “anti-money laundering compliance for cryptoassets.”

The economists suggest to leverage “the provenance and history of any particular unit or balance of a cryptoasset” to implement a risk-scoring scheme with on- and off-ramps that would exclude any asset that has ever passed through a no-KYC wallet from being accepted by regulated entities.

With this approach, the BIS aims to create “a culture of ‘duty of care’ among crypto market participants,” leading users of non-custodial wallets to not accept no-KYC coins and opt for KYCing their own coins voluntarily.

“While customer verification can be performed at points of contact with the conventional monetary system (eg by crypto exchanges) […] once claims move to unhosted wallets on the permissionless blockchain itself, the transactions are out of the reach of conventional forms of intervention,” the BIS economists write.

By using public transaction histories, “a diagnostic ‘AML compliance score’ could be referenced in any further interventions by authorities when cryptoassets (including stablecoins) are presented for conversion to fiat currency at the ‘off-ramps’.”

How The Allow Lists Work

“An AML compliance score that references the UTXOs for bitcoins or wallets for stablecoins could use the information on the blockchain, including the full history of transactions and the wallets they have passed through,” the economists explain.

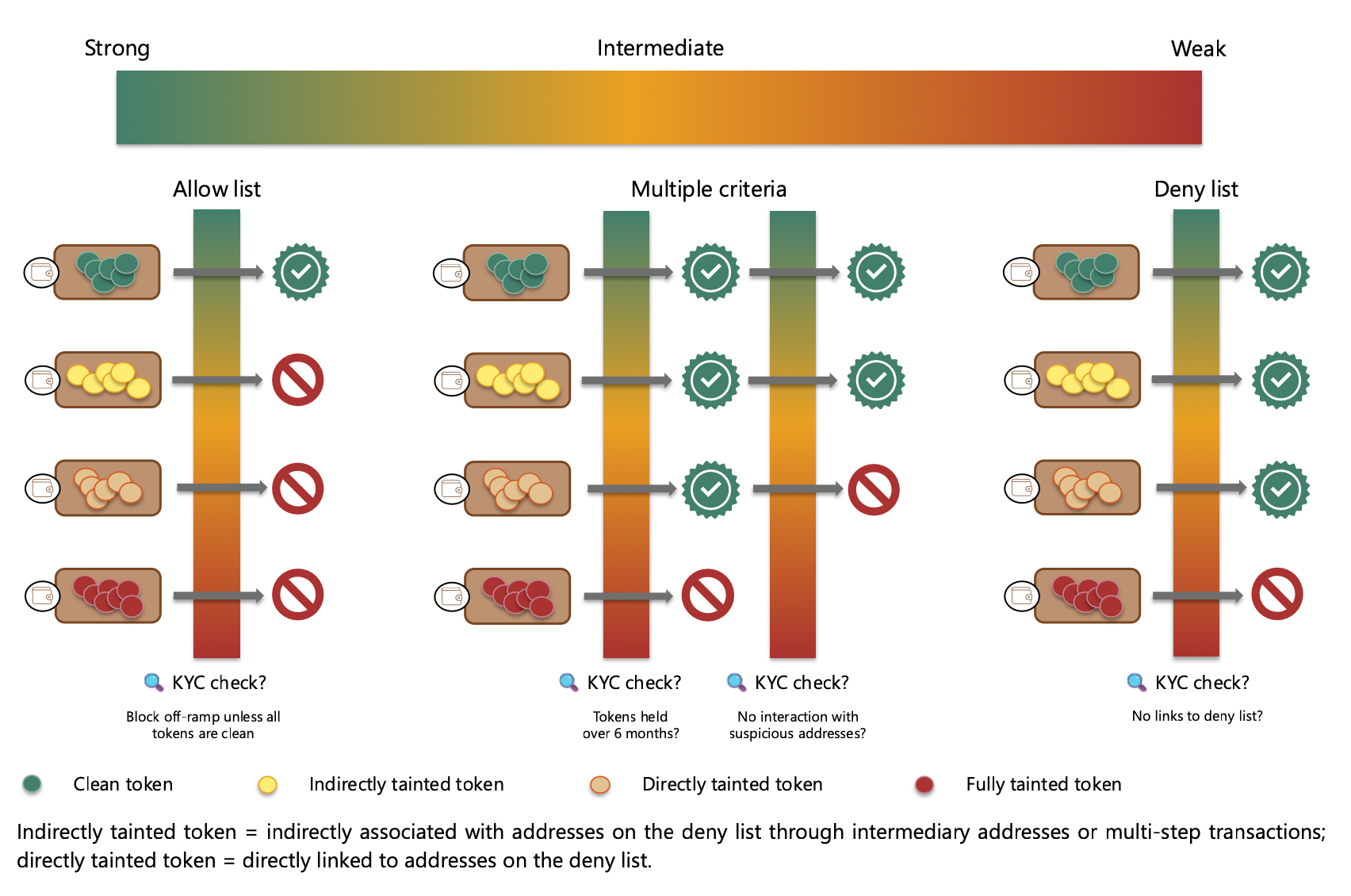

“A higher value (eg maximum 100) would denote relatively clean funds, coming mostly from ‘allow-listed’ wallets, while a lower value (eg minimum zero) would denote funds that are tainted by being associated with one or more wallets known to be on a ‘deny list’,” the paper elaborates.

“The strongest form of AML compliance would require off-ramps to accept tokens for conversion only if they have passed through addresses that have met KYC compliance checks – ie wallets that are on an ‘allow list,'” the economists further elaborate.

“This stringent version of the AML test implies that all users (including those operating unhosted wallets) would have to undergo KYC checks, just as all clients of banks must do when opening an account today,” the paper states.

Exchanges and “other wallet providers” could then be required to block any transactions from or to wallets that are not on the allow list. “For bitcoin, it is possible to assess whether a UTXO (or part of it) has ever passed through such an address,” the economists highlight.

Enabling Self-Policing

The approach suggested by the economists aims to tackle the problem that non-custodial wallets are not operated by intermediaries, and therefore can hardly be regulated. The proposed solutions aim to affect a “broader impact on the crypto ecosystem, including endogenous changes in the behaviour of illicit actors and associated shifts in the allocation of the ‘duty of care’ between crypto users and authorities.”

The approach would require “defining which actor is responsible for preventing illicit flows,” which “could be the individual user,” the economists suggest.

“While some users may reasonably claim to have received a tainted token in good faith if information on illicit use is scarce,” the paper states, “such an argument would be less persuasive if there were widespread and affordable compliance service providers.”

“In such a setting, users could reasonably be expected to exercise a duty of care in transacting with crypto tokens by checking beforehand if a crypto coin is known to be compromised. Approaches that clearly define responsibility create incentives for good actors to seek out illicit activity and report it to authorities.”

“Compliance scores of the type described here could also generate incentives to support better outcomes in terms of overall compliance,” the economists further state. These compliance scores could then “accompany the token as it moves within the permissionless blockchain – embedding the score into the UTXO or wallet itself.”

The goal is to influence the behavior “even among those transacting solely through unhosted wallets.”

“If such duty of care took hold, there would be an incentive to transact with clean allow-listed wallets that could generate a positive feedback loop in terms of compliance,” the economists conclude.