(Headline article below) When it all boils down, 401k accounts are kind of a scam as companies forgo pensions putting the retirement responsibility on you. So the OCGFC get your money into one of their financial megacorps to create investment bubbles and unless you intervene in how its invested you take the financial hit when things crash. And then the financial megacorps treat you like a nuisance for wanting to have access to your money, not to mention the tax penalties you pay if you take funds out early. You’d be better off paying the taxes and investing it yourself, and as long as you keep capital gains under a certain amount per year, you don’t have to pay capital gains taxes on your gains.

A capital gains rate of 0% applies if your taxable income is less than or equal to:

- $47,025 for single and married filing separately;

- $94,050 for married filing jointly and qualifying surviving spouse; and

- $63,000 for head of household.

https://www.zerohedge.com/personal-finance/401k-early-withdraws-rise-above-historical-norms

By Tyler Durden

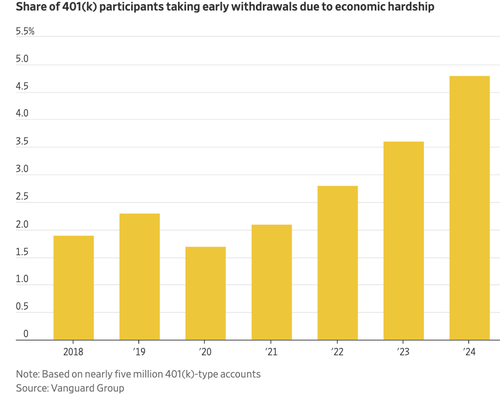

Financial emergencies have driven more Americans to tap into their 401(k) accounts—a trend already underway before President Trump took office. Much of the financial misery stems from the inflation storm sparked by the Biden-Harris regime. Now, the surge in early 401(k) withdrawals has drawn the attention of the nation’s second-largest retirement plan provider.

Empower CEO Ed Murphy joined Bloomberg TV on Monday to discuss the alarming trend of early 401(k) withdrawals. These funds have become Americans’ rainy-day funds, used to prevent foreclosure and pay medical bills.

An early withdrawal for those under age 59 ½ comes at a 10% penalty. Murphy said withdrawals from 401(k)s are running about 15% to 20% above the historical averages.

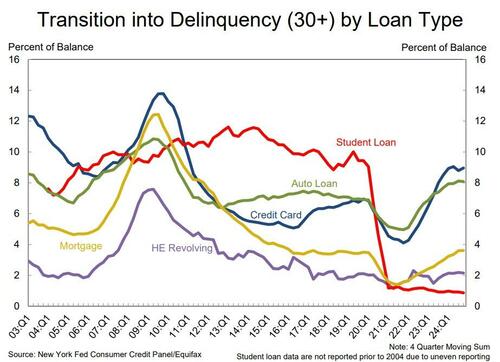

“There is a corollary to what you are seeing in the US economy with deferred payments on auto loans and mortgages,” he said, adding, “That’s something we monitor carefully.”

“If you’re in retirement or you’re nearing retirement, and you see this kind of a decline, it can be a bit concerning,” says Empower CEO Ed Murphy.

He recommends everyone have at least 2 years worth of emergency funds during these turbulent markets https://t.co/2uC5nvdVQE pic.twitter.com/5lNURXHNMT — Bloomberg TV (@BloombergTV) April 7, 2025

A recent report from Vanguard Group found that 4.8% of account holders in 2024 made early withdrawals. That’s up from 3.6% in 2023 and a 2% pandemic-level average. Data is based on nearly five million 401(k)-type accounts managed by Vanguard.

“While experiencing hardship is not a good thing, having savings to turn to is a positive,” David Stinnett, head of strategic retirement consulting at Vanguard, told WSJ.

These 401 (k) hardship withdrawals have been running at elevated levels well before Trump stepped into office. We previously noted “US Consumer Is Melting Down” and warned that the lower-income cohort finally tapped out last month. Again, another trend lingering from failed ‘Bidenomics’.

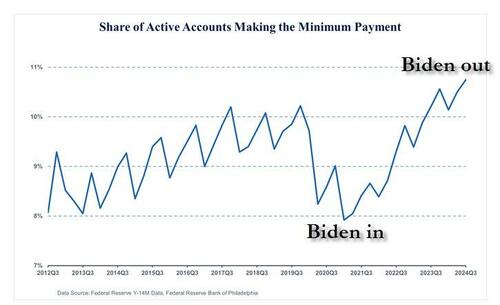

And how do we know this is certainly not a Trump phenomenon? Well, much of the financial stress for consumers erupted under Biden. It’s merely a continuation.

In addition, more consumers are falling behind on their monthly card payments.

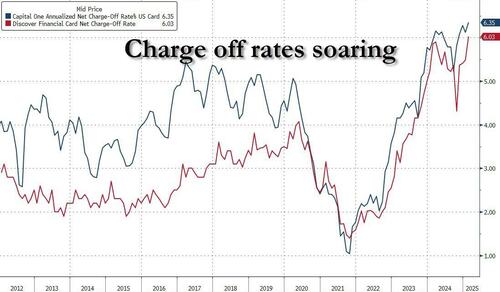

It’s even uglier when looking at the charge-off rates.

More bad news for the consumer arrived on Monday…

6-Sigma Miss In Consumer Credit Confirms US Consumer Is Finally Down And Out https://t.co/04XsTaksNn — zerohedge (@zerohedge) April 7, 2025

. . .