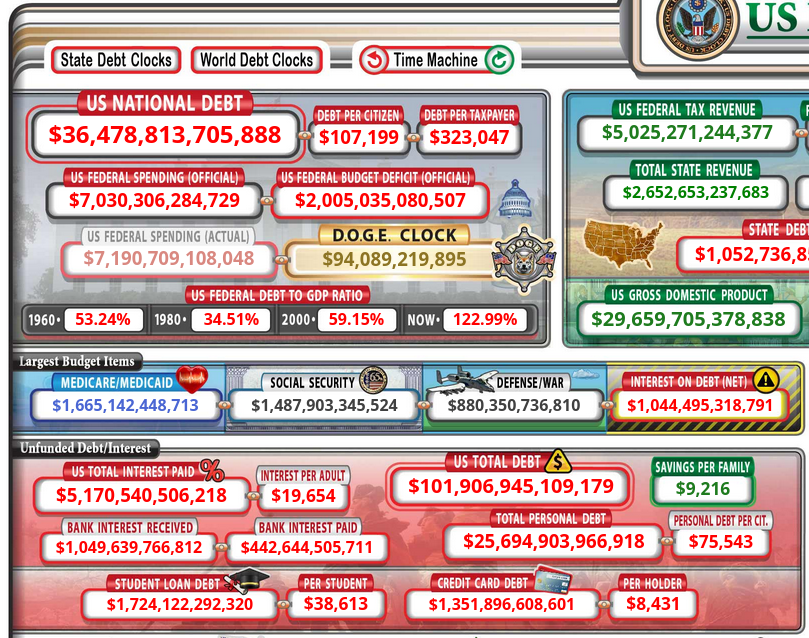

From my post in December, the debt per taxpayer number was $271,791, but below you can see that it has shot up to $323,047. That would seem to point to a significant number of retirements or people leaving the workforce as the debt per citizen is about the same. The article below covers just how terrible this will be over the next decade, but look at how interest payments are more than defense spending today, and a third of Medicare/Medicaid and Social Security combined. This is important in analyzing the article’s point below about medical spending. Worth pointing out, Trump ran up the debt in his first term and has talked about continuing to run budget deficits, and you can see DOGE so far is a drop in the bucket of total government spending, probably to be more theater than actual substance (still fun). But below, pay attention to the unfunded total US debt, almost $102 trillion, and some estimate this is actually much higher. So you could say that the debt per taxpayer is closing in on $1 million. Of course, a lot of this debt will be effectively wiped out in the incoming financial crash and depression, but you won’t be selling much new debt to run the government then, or collecting as much in taxes.

By: Christopher Jacobs

By 2035, CBO believes net interest payments on the deficit will ‘account for about one-sixth of all federal spending.’

The Friday before Inauguration Day, the Congressional Budget Office (CBO) illustrated the fiscal challenge facing President Trump and the new Republican Congress. In a short version of its annual Budget and Economic Outlook, CBO quantified the whopping $21.8 trillion in budget deficits the federal government faces in the coming decade.

While the updated numbers only marginally constitute news — CBO has warned for years about our dire financial future, only for lawmakers to keep spending — one particular nugget illustrates the problem. The budget gnomes significantly increased their spending projections for Medicaid, as but one example of how entitlement programs continue to cannibalize the federal budget.

Double-Digit Growth in Medicaid

Appendix A, which contains all the changes — legislative, economic, and technical — to the fiscal baseline since CBO’s last update last June, contains a sizable change in the last category. Among the technical “tweaks,” the budget office increased projected federal spending on Medicaid over the coming decade by $817 billion, or 12 percent. Most of this projected increase has to do in one way or another with administrative actions by the Biden administration.

Chief among the factors driving the spending explosion were continued increases in Medicaid enrollment, even after states were finally permitted to remove beneficiaries from the rolls following the pandemic (something they could not do during the Covid “emergency”). CBO increased projected enrollment for calendar year 2025 from 79 million last June to 84 million. It also noted that the enrollees remaining on Medicaid have generally worse health than those who were removed from the rolls, resulting in “significantly higher than expected” costs per enrollee last year — which CBO believes will force state Medicaid programs to raise their rates to the managed care plans that provide coverage.

Other factors also drove the growth in the Medicaid spending estimates, including projected increases in enrollment among individuals with disabilities — a result of Biden’s rules expanding eligibility for the Supplemental Security Income program — and rising drug costs, attributable in part to Biden’s recent proposal to require Medicaid programs to cover GLP-1 drugs to control obesity. CBO assumed a “modest increase in expected coverage expansions” under Obamacare, meaning more red states will decide to cover able-bodied adults (which they should not do).

Finally, the budget office assumed that another Biden regulation will raise Medicaid spending. Specifically, a rule on state-directed payments will encourage states to raise reimbursement levels to draw additional federal matching funds. In a recent paper for the Paragon Health Institute, I suggested that Congress or the new administration should repeal many of these requirements, which provide examples of the executive branch spending money without congressional approval.

Need to Reform Spending

The growth in Medicaid spending comes against the backdrop of continued high deficits, which have approached $2 trillion per year and in CBO’s estimation will only continue to grow. Within the decade, the national debt from these accumulated deficits will top 106 percent of our gross domestic product (GDP) — an all-time high, exceeding levels just after World War II.

All of the numbers in the CBO report sound atrocious, but one stands out: Over the coming decade, the United States will spend a total of $13.8 trillion on interest payments alone. By the end of the decade in 2035, CBO believes that net interest payments will “account for about one-sixth of all federal spending.” Think about it: If you spent one-sixth of your income just paying off the interest on your credit card — not the principal, mind you, but just the interest — you would be in dire financial shape. That’s what the next generation faces in the years and decades ahead.

If there’s one silver lining, it’s that CBO had to release what it dubbed an “abbreviated” version of its Budget and Economic Outlook, “to facilitate work on other Congressional priorities” — most likely, various analyses of budget reconciliation provisions that the new Republican Congress may consider. Here’s hoping reconciliation legislation will at long last contain efforts to reduce, rather than increase, the spending that got us to this place.

Chris Jacobs is founder and CEO of Juniper Research Group and author of the book “The Case Against Single Payer.” He is on Twitter: @chrisjacobsHC.